As signs continue to build warning of instability in equity and financial markets this autumn, we observe that the index of major U.S. banks is lagging in comparison to benchmarks such as the S&P 500, the NASDAQ 100, and the Russell 2000. While the other indices are making a better showing of testing areas near their 2015 highs, the KBW Bank Index (symbol BKX) may be on the verge of making another lower high.

This is important, because it appears to us that each of the major U.S. stock indices is working through its own topping process this year. With BKX entering that period already at a lower high, its next downward swing may be relatively more severe.

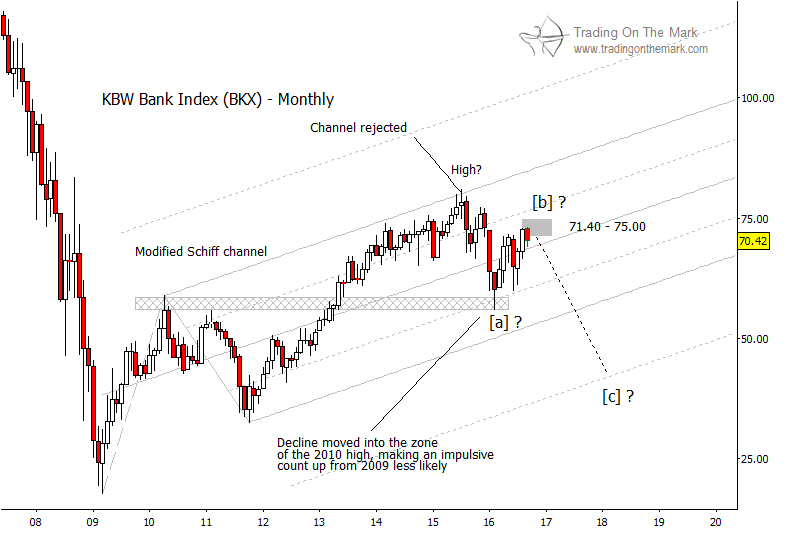

In terms of pattern and form, we expect BKX to make a three-wave [a]-[b]-[c] move down from its 2015 high. Wave [a] tested a support zone where earlier resistance had been overcome, making the zone supportive on first test. Now the index has retraced the decline to test standard areas of Fibonacci resistance.

The first target of a declining wave [c] should be the lower boundary of the modified Schiff channel that we have drawn on the chart. However, we believe the channel should provide support only briefly. Eventual targets should be substantially lower than the terminus of wave [a] – perhaps near the next major channel harmonic.

A 30% to 40% decline during the next two years would not be unreasonable, but it will be easier to define specific targets after the high of wave [b] is confirmed.