Yesterday, I published this write-up titled A Long Swing Trade in BIDU, in which I articulated the reasons behind the trade, as well as presented the corroborating technical evidence.

Long story short, the stock reached the minimum target of $187 this morning, leading us to take action according to the game plan tweeted an hour earlier (see below). Specifically, we exited the October 14th $185 calls (~57% profit), leaving in play the October 7th $182.50/$185 bull call spread. However, to leave this call spread out in the open, susceptible to the market’s treacherous hand, would be unconscionable. So, upon price reaching $187/share, we quickly converted the bull call spread into a long call condor by “selling to open” the October 7th $190/$192.50 bear call spread.

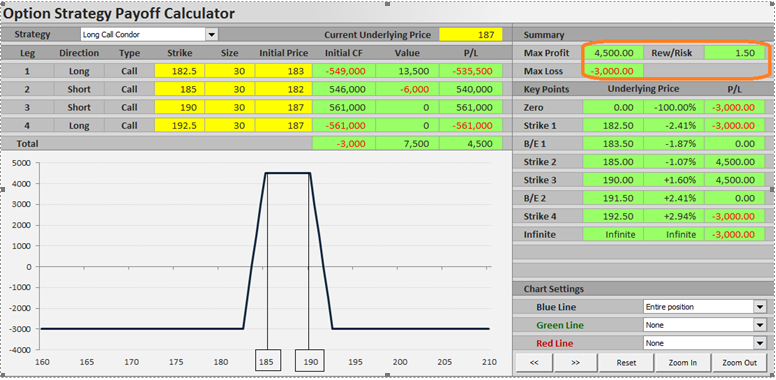

The payoff diagram associated with the long call condor strategy is shown below:

Long 30 x October 7th $182.50/$185 bull call spread

Short October 7th $190/$192.50 bear call spread

Clearly, the maximum profit of $4,500 would be realized if price should close between $185 and $190 on Friday (weekly expiration). Why? Because in this price range, the October 7th $182.50/$185 bull call spread and the $190/$192.50 bear call spread would expire in the money and out of the money, respectively. Conversely, should this trade go against us, the maximum loss would be $3,000, as indicated by the payoff diagram. That’s a reasonably good reward risk of 1.5. Keep in mind, however, that we’ve already booked close to $6K in profit on those directional $185 calls expiring on August 14th, which we bought at $315/contract and unloaded at $495 this morning.

When it comes to trading, technical analysis is practically an indispensable evidence-gathering tool; you wouldn’t cross a street without first looking left and right, would you?

Trade Smart,

Peter Ghostine (@peterghostine)