Given the short term nature of most Binary Option trades, there seems to be an emphasis on technical analysis over more fundamental factors. This sometimes neglects the importance of the intrinsic value embedded in the asset.

This is usually neglected because fundamental factors take a longer time to materialise. Examples of fundamental factors include the PE ratio, the price/book, enterprise ratios etc. Fundamental analysis also takes into account external factors that could have an effect on the price of the security in the future such as macroeconomic factors. These factors range from the current interest rate to political impacts, from GDP growth to consumer confidence.

The most important question that needs to be addressed, however, is how a trader makes use of fundamental factors when making decisions related to trading Binary Options. This is made even harder by the fact that a number of platforms only offer technical tools and indicators for the trader. This is why many traders choose to use third party platforms such as the Meta Trader 4 which pulls in more fundamental factors.

When it comes to Forex, the Meta Trader platform has extensive information on global macroeconomic variables which could impact on the currency pair being considered. For example, I always look at the consensus estimates for inflation variables in the UK and compare that to my own estimates. I am then able to position my GBPUSD to most appropriately make profit depending on where the actual inflation number prints. I also look at factors such as China’s growth in determining the demand and price of iron ore and hence also the Australian dollar. When completing these trades with binary options, the shortest expiry time I take is a 24-hour option. Choosing a shorter expiry time tends to create too much noise around the more fundamental path of the forex pair.

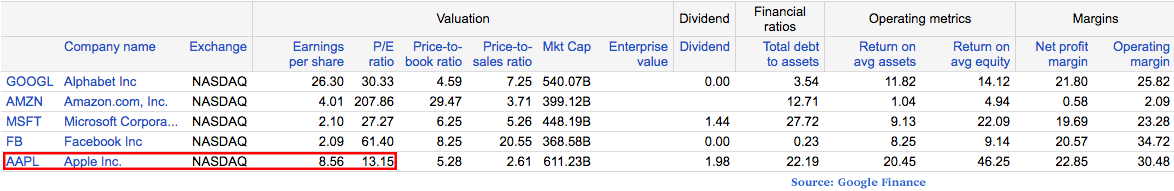

While fundamental analysis in Forex is restricted to macro-economic factors, when looking at Stocks the underlying company can also be analysed. Unfortunately, Meta Trader 4 does not offer much company fundamental analysis. This is where other news services such as Google finance are quite helpful. Generally, companies that have a lower PE ratio are cheaper relative to earnings power. Assuming that the growth opportunities look promising for the company, it may be advantageous to enter a binary option trade over a longer time period such as 6 months or even 1 year. This will allow the efficient market to eventually price in the discrepancy that you observe. For example, before I placed a 6 month binary call option on Apple’s stock, I noticed that the PE ratio was quite low compared to its peers (see tables below). I also have a more fundamental view on how well iPhone 7 sales will go and lead to better earnings.

Another important indicator of fundamental value is the type of investors who are purchasing the stock. Unlike many assets, if an investor takes a large stake in a particular company then they have to disclose it. Hence, if you were considering placing a binary trade on a company and an investor such as Warren Buffet was also increasing his stake in the company at the same time, then you would have more conviction in your fundamental viewpoint (Mr Buffet’s bread and butter). As we know, Warren Buffet recently increased his stake in Apple by 55%, a further reinforcement of my conviction.

Of course, what most good traders do is to use not only one form of analysis. Although I tend to use fundamental analysis to inform a lot of my trading, I am always observing the technical indicators over a range of time scales. Although less useful over a longer time period, technical indicators could give an indication of the short term direction of the currency pair / stock. This will allow you to better time the entry of your long term fundamentally informed binary options trade.