As is now widely known, the UK voted to leave the EU on the 24th of June. It has already been 100 days since the vote and the GBP has been trading in a very volatile fashion. As we look forward to the next few weeks, there are a number of views as to how the GBPUSD will trade. We can form views as to how it will develop based on a fundamental economic view and a technical chartist viewpoint. I will examine both of these views together with a look at the opinion that is been formed by professional currency forecasters.

The Fundamental View:

The last three months of 2016 will be very important for GBP and UK assets in general. As the conservative party gets underway, we are bound to hear more about the manner in which Brexit will be implemented. In fact, there are already confirmations from Theresa May that Article 50 will be triggered before March next year. Assuming that the next few months of Economic data are soft, GBP may come under more pressure. Similarly, the negation process needs to be implemented in an effort to maximum disclosure.

Post Brexit, GBP had actually held steady and showed a rather strong performance. However, it seems to have come under more pressure throughout September. It has even tested the post referendum lows of 1.2870 although it has managed to find support at these levels. What most fundamental investors will be looking to is the PMI numbers for September. This comes off the back of some really strong numbers for August where the PMI had the biggest monthly jump in over twenty years from the July level.

Despite this strengthening in the economic data, the BOE has not ruled out another interest rate cut. However, it remains unlikely that the bank will change interest rates in the December meeting but rather hold off until the inflation report is released. Hence, the unless the bank decides to cut rates in November or it will delay it until early next year.

It is important to watch the PMI data this week in order to form a view on how the BOE may react this November. If the PMI number continues to improve, then Mark Carney is more likely to not adjust the current rate. However, if there appears to be a loss in momentum, then a rate cut is more likely than not. Similarly, weaker PMI numbers may also drive GBP to lows not seen since immediately after the referendum.

Aside from the economic factors surrounding the exit, the political developments are also key to predicting GBP developments. The EU has just appointed its chief negotiator who is keen to accelerate the exit as well as driving a hard bargain. The UK is still trying to maintain access to the single market while restricting access to the free movement of people. This is something that the EU commission has declared a red line.

In fact, there are many reports at the moment that a ‘hard’ exit is increasingly likely. Under the terms of such an exit, the UK will leave the EU trading block and move onto WTO trade terms. With these potential political and regulatory uncertainties, GBP is likely to continue trading in a volatile range.

The Technical View

When looking at the technical indicators, the 1.2000 handle seems to be offering some sort of psychological support. This can be seen from the sharp rebound from the flash crash on Thursday morning. However, the forming trend appears to be angled towards the downside as the pair appears to be forming a series of lower lows and highs.

Another important indicator to look at is the Relative Strength Indicator (RSI). As we can see, it is pushing into oversold territory. This bearish trend in both the price and the RSI shows that there may still be opportunities to sell bounces in GBPUSD with former support at 1.2920.

What are the experts saying?

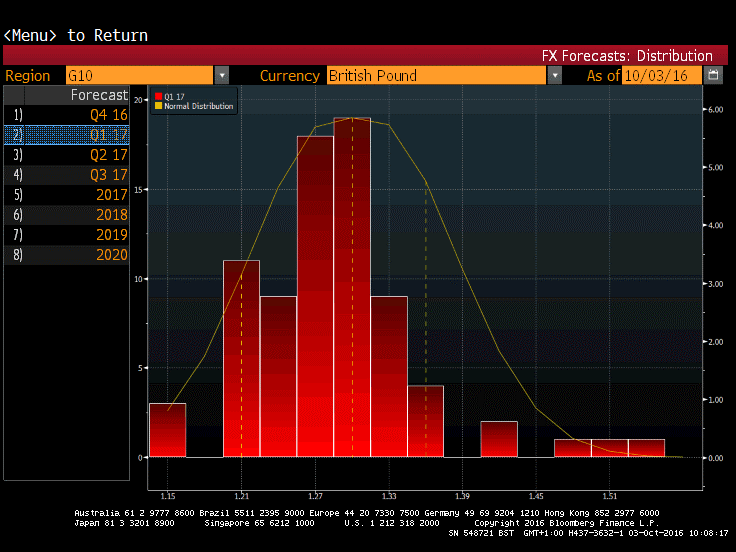

When we take a look at the broad analyst forecasts for the Q4 2016, it shows that the majority of analysts predict the currency pair to remain between 1.26 and 1.32. This can be seen in the analyst distribution from Bloomberg. The distribution appears to be a bit skew implying that many analysts are of the view that GBP is unlikely to face a precipitous fall in the next 3 months. When we take a look at these analyst forecasts for Q1 and Q2 2017, the outlook appears to be a bit more uniform but angling towards lower levels. In both first 2 quarters, the median analyst forecast has GBPUSD at 1.30. However, the distribution of forecasts for early next year appears to show a skew to a weaker pound. What this implies is that most professional currency analysts predict Sterling to depreciate further in the beginning of 2017.

You can apply for membership at the Binary Trading Club and talk directly with Janet. The Club’s main aim is to help it’s community of traders to reach their individual trading goals.