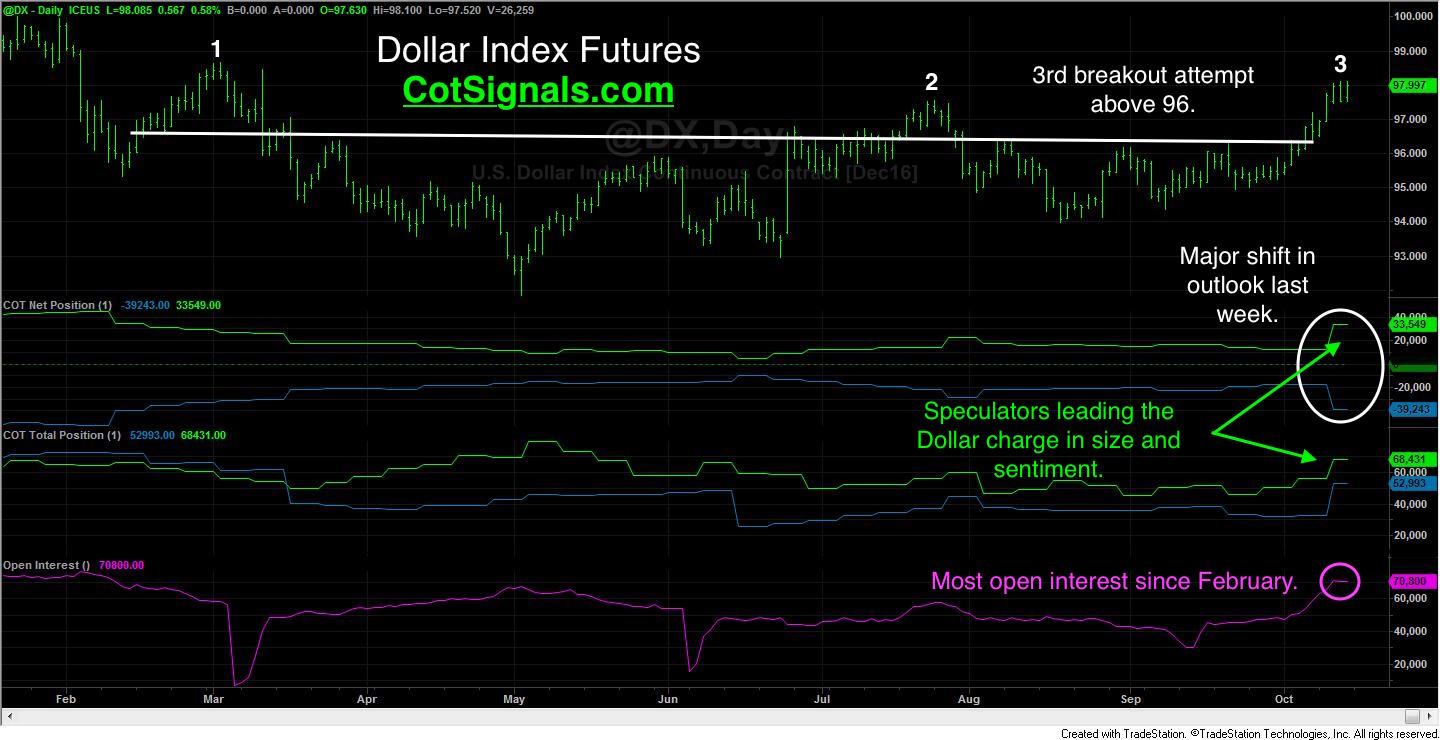

Last week marked the indications of a change in sentiment among the commercial traders. While much of the week was spent watching the Dollar rally and the metal and Bond markets decline, the commercial traders, who’d been gently wading into these markets, appear to have jumped in with both feet. Looking at this through the analysis of the Dollar Index shows that there was a dramatic shift in sentiment between the commercial traders and the speculators. We’ll examine the Dollar Index chart, below and take a look at some correlational evidence that suggests the Dollar’s third attempt above 96 may simply be another false start.

Last week in the US Dollar Index futures, the commercial and speculative traders created new opposing positions to the tune of approximately 45k contracts. Their contradicting actions the largest one-week divergence of positions since January of 2015. The January move began to reconcile itself in favor of the commercial traders after both the commercial and speculative traders set opposing net position records that March. The recent action is made more notable by the charge in the large speculators’ total position, which continues to outpace the growth of the commercial traders’ total position and is similar to the speculatively fueled trading pattern exhibited at the early 2015 high.

Next, I’d like to look at the commercial traders’ actions in the precious metals. Commercial traders have finally gotten the decline for which they’ve been looking. It’s important to understand that both gold and silver were at or, near-record bullish speculative positions just last month. Similar to the sideways action we’ve experienced in the Dollar, forward selling by precious metal producers eventually wore down the speculative insistence upon higher prices. We expect that last week’s push above 96 creates a similar last-gasp higher, perhaps testing the magic 100 level, once again.

We can see the commercial traders actions in the metal markets as prices have fallen reinforce our big-picture idea. The current action on the gold market’s decline clearly shows that commercial short hedgers have backed off their selling and even begun to cover a bit as gold fell to $1,250 and silver below $17.50. In fact, we are even starting to see long hedgers step up to the buy side on the market’s declines. The long hedgers’ purchases show that commercial traders expect the general ebb and flow of the markets to continue, even through next month’s election.

Our short-term trade will focus on a reversal lower in the US Dollar Index. While we could see some speculative push, we believe that the commercial traders will provide the resistance necessary to keep this swing-high inline with the current market structure. As always, we’ll publish the Dollar Index sell signal in our Discretionary COT Signals nightly email along with the appropriate protective buy stop once we feel the market has turned.