THIS WEEK AND THROUGH NOVEMBER

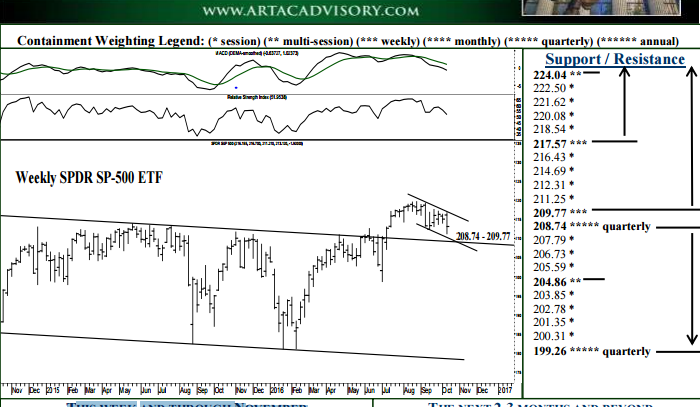

The 208.74-209.77 formations can absorb selling pressures through the balance of the year – above which a secondary long-term buy signal remains in effect, expecting 217.57 within 1-2 weeks, 231.76 – 33.29 by the end of the year (bottom page 2). Upside this week, 217.57 can contain weekly buying pressures, once tested the market vulnerable to slipping back to 208.74-209.77 within 1-2 weeks. A weekly settlement Friday above 217.57 indicates a good October low, 224.04 then expected by the end of next week, 231.76-233.29 attainable over the following 5-8 weeks where the market should top out through Q1 2017. Downside this week, a daily settlement below 208.74 signals 204.86 within 3-5 days, while a weekly settlement this Friday below 208.74 maintains a heavy dynamic into November, 199.26 then becoming a 3-5 week target likely to contain selling through the balance of the year.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE