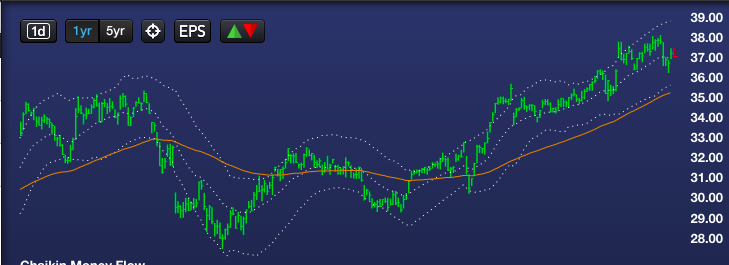

Today we are talking about Intel (INTC) earnings. They release 10/18/2016 after the market close. The trend of the chart is very strong. The tech sector in general has been quite strong as well.

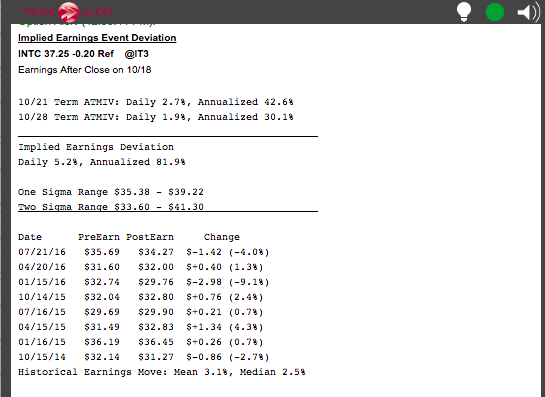

Earnings have been a strong suit for INTC over the past two years having gone down only three times in the last eight releases.

Institutional money flowing into INTC has been strong (although a bit waning, relative strength when compared to the SPY ETF has been strong and aggregate fundamentals is solidly bullish. With an implied volatility for Friday at 43%, this targets a move of about +/- 4% which to the upside targets the $39.00 strike.

We signaled the following:

Buy (opening) the INTC October 37.5 call

Sell (opening) the INTC October 39 call

For a maximum debit of $0.45.

This signal is not GTC, is a day order only and is valid with INTC trading $37.00 or higher.

The maximum return on risk is 2.33:1 which would yield $105.00 for each one lot bought.