Each week, a group of dedicated traders meets at the author’s website to practice the craft of trading. Traders are guided through simulated trading situations that challenge both their technical and mental trading skills. Like athletes training with a coach, traders cultivate rapid skill development, including trade selection, entry and management skills, as well as mental abilities in evolving market situations.

Case Study: Liam’s Trade

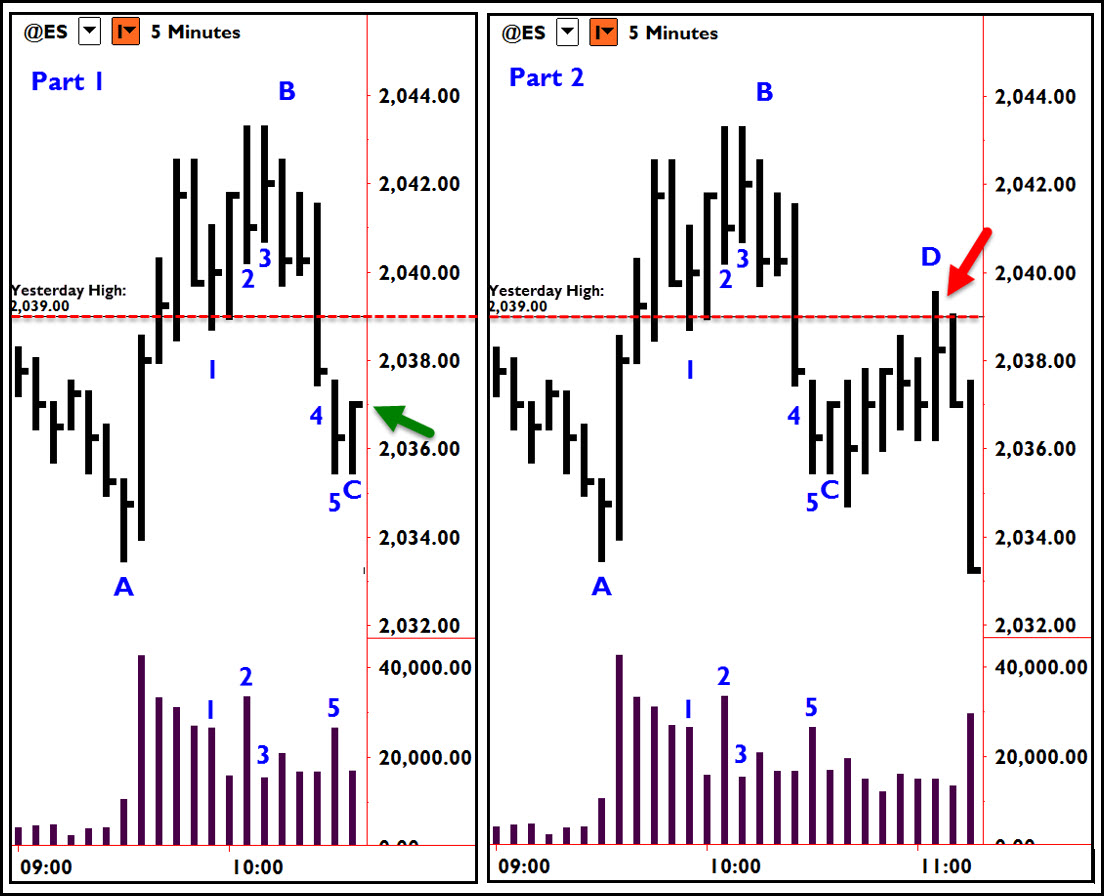

One newer trader entered a long trade on the close of bar C on Part 1 of the accompanying chart. Liam reasoned that the high volume at bar 5 and it’s narrowing range was evidence that buyers stepped in to stop the down move from the highs of B.

Although Liam read the bar and volume correctly, it wasn’t a high quality trade. The market could still drift lower to test the low at A, despite the stopping volume. Also, yesterday’s high—immediately overhead—would likely prove to be resistance. The trade had neither supportive market context nor appealing risk-reward.

Liam admitted that impulsive overtrading handicaps him. He often doesn’t wait for trades to set up properly. He said, “I do give back a lot of profits from losses made on [unsound] trades like this one.”

Many traders have had similar experiences.

Case Study: Liam’s Psychology

Impulsive trading isn’t a character flaw or personality failure. It arises from our normal way of thinking.

Think of our minds as having two parts: One part of our mind is rational and logical. We call it “deliberative mind” and it’s especially good at problem-solving and choosing the best alternative in complex situations.

The other part of our mind is great at seeing the most important features of a situation and is super quick in coming to conclusions and making judgements. We call this mind “intuitive mind.”

Both parts of our mind are important. Our intuitive mind helps us negotiate common, everyday situations and quickly make judgements about familiar situations. The more deliberative part of our mind helps us assess complex and novel situations. We run into trouble, however, when we apply the wrong part of our mind to a given situation.

Liam’s Error: Relying on the Wrong Part of the Mind

Liam made the snap judgement that the market would rally based on the prominent features of volume and range (bar 5). He relied on his intuitive mind, and that can be dangerous in trading. High quality trades are identified by deliberation and careful analysis, not quick decisions. However, this part of our mind is difficult to engage. It takes extra effort. Our intuitive mind sees something appealing and wants us to act—now! We often don’t even think about thinking things through.

But we need to if we want to be good traders.

Liam Uses the Right Mind for a Choice Trade

We follow Liam’s trade in Part 2 and see the market did respond to the high volume, but the rally to D was weak with overlapping price bars and low volume. Liam was asked to think carefully (i. e., engage his deliberative mind) about what he wanted to do as the market returned to the prior day’s high. Here’s what he said:

“I see the market rallied up from A and through yesterday’s high, but the volume was still heavy as it tested at bar 1. That could be supply. Selling clearly came in on bar 2, and then there was no further demand at bar 3. The market was unable to rally after breaking the high. It then fell easily on bar 4. The market does move up, but without strong buying as it tests yesterday’s high (at D). This market is weak. The selling is stronger than the buying and we are at resistance. I want to close the long and go short. My target is a least the low at A.”

And that is a high quality trade! Liam looked at the entire context and thoroughly pieced together a story of selling at an important resistance area. He used the correct part of his mind and his technical skills to identify a choice trade.

By training both mental and technical skills in a supportive simulation environment, traders can quickly develop knowledge, skills, and abilities. If you would like to know more about how structured practice can improve your trading, you can visit the author’s website where you can learn about his unique Deep Practice program. Just click here.