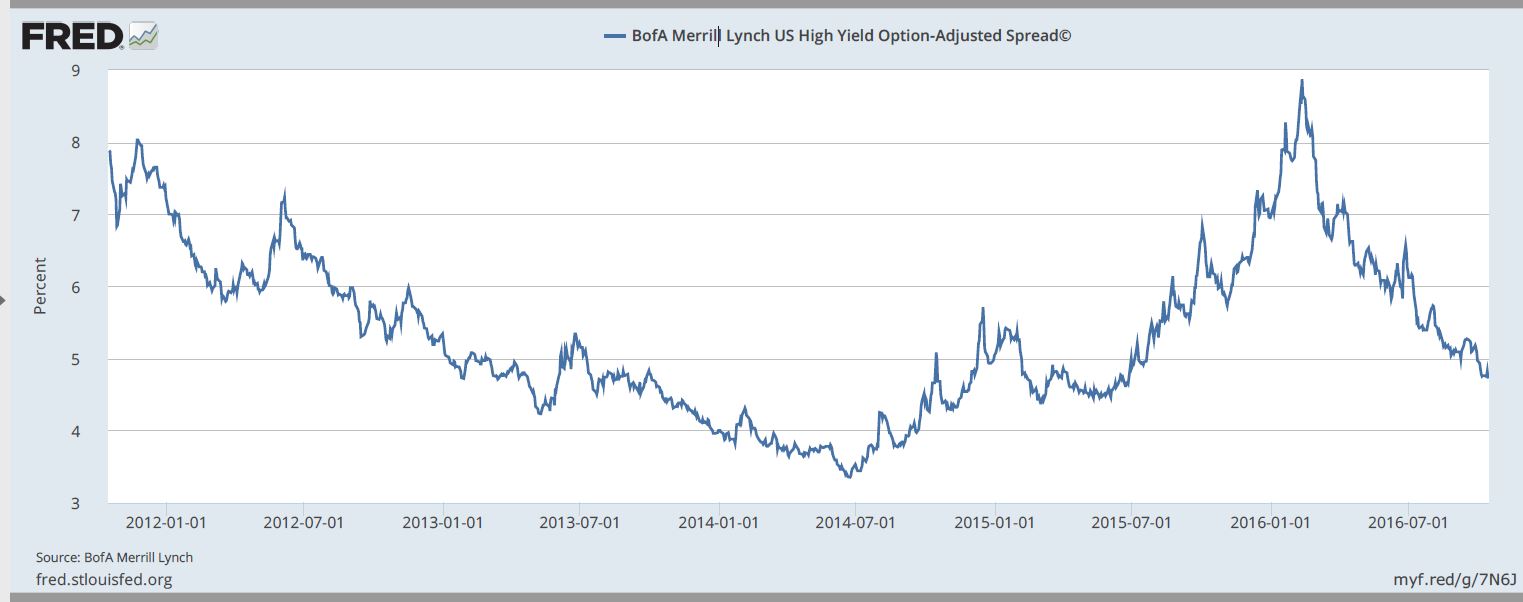

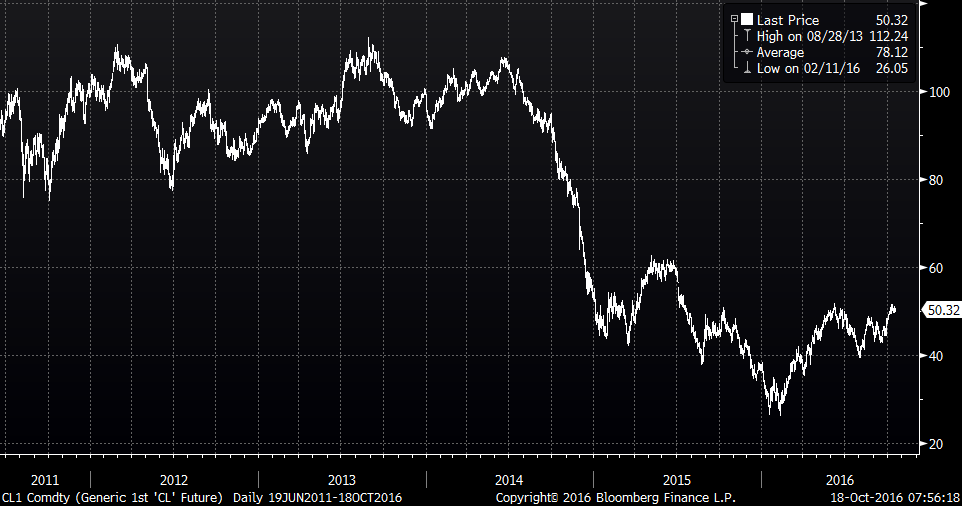

The below charts are not exactly a mirror image, but the rally in high yield has been pretty remarkable since the spike in spreads in Q1. It might be hard to see on the (top) chart, but the spread (BofA ML US Hi Yld Spread) was nearly 9% in Q1 and has compressed all the way back to 4.75. The primary reason for the surge in hi-yield rates (from Q3 2015 to Q1 2016), was the decline in oil prices, but the spread compression appears somewhat overdone as compared to the recovery/stabilization in oil. The lower chart is a continuous front month Crude Oil contract.

OK, so why is this even remotely interesting or important?

To my way of thinking, these two charts loosely relate to challenges facing the Federal Reserve. First, consider the high yield spread, which, for our purposes can be thought of as a proxy for spreads of all corporate debt as compared to treasuries, i.e. all spreads tend to compress or widen together. One of the goals of QE is reflected in the top chart, as spreads declined from 2012 into 2014. Tighter spreads mean cheaper and easier access to credit for companies, which ought to be a stimulant for the economy. The lower chart is oil, which is a large input for the US economy, and typically thought of as a ‘tax cut’ or additional stimulant (mostly for the household sector). On the negative side, energy companies were priced out of credit markets because of revenue declines and high existing debt levels, which in turn caused layoffs etc. However, what we’ve seen since Q1 is that the oil price has stabilized; indeed it has doubled since January.

While the Fed does not directly influence the price of oil, it clearly figures into monetary policy.

Though it has firmed this year, the related compression in high yield spreads acts as a stimulant. Additionally, year over year comps in energy prices are about to filter into inflation data. The point, and this goes more in the ‘food for thought’ category than ‘direct cause and effect’ is this: Recent compression of corporate spreads and the concurrent bounce in oil are both reasons that the Fed may end up being more aggressive in tightening over 2017 than the market believes. Currently, the market only expects one hike (or maybe 1.5) over 2017. I think it’s plausible to think 2 or more could occur.