USDA Report and Seasonal Tendency Set the Table for Option Writers Now

With a messy election year entering its home stretch, an expected Fed Rate hike looming in December and a historical precedent of painful setbacks, October is shaping up to be a spooky month for stock investors.

Indeed, with high profile analysts such as Gluskin Sheff’s David Rosenberg calling for a “perfect storm” correction in the stock market, stock investors, and even stock option sellers, are getting a bit twitchy.

Even if an overdue correction doesn’t come, diversification into non-correlated asset classes is always a good idea. This is especially true for high net worth investors where limiting oneself to a traditional asset mix can have catastrophic consequences (see 2008).

The diversified commodities market can be a perfect solution for those seeking uncorrelated growth and/or income. Despite the emotional swings of the stock market, life goes on in commodities. Even while the public places panicked calls to their stock broker, they’ll do it while calling from their gas heated home, drinking a cup of coffee, feeding the kid a bowl of corn flakes. Just because the stock market tanks, you don’t ration Junior’s breakfast. Thus commodities prices, whether moving up or down, are more likely to be reflecting their internal supply/demand fundamentals that anything going on at the NYSE.

Trying to predict future price moves here however, is every bit as difficult as in stocks. This is why when seeking consistent longer term growth in commodities, it pays to NOT try to be a fortune teller.

Instead, you can use option strangles to potentially profit in good times or bad. And an optimal situation for deploying such an income generator now appears to be shaping up in the Soybean Market.

Soybeans: Seasonal Tendency Points Higher

Soybeans have been in a fairly consistent bear trend since early summer. This had made them an excellent market for call sellers (see our market advisory from August 18.)

Soybeans however, are a highly seasonal market. Our call selling suggestions in July and September were based in large part on the seasonal tendency for soybean prices to decline into the US harvest. With record production expected this year, soybean prices obliged and fell by over 20% since its highs in June.

But October can often be a month where soybeans establish a price floor – known as the “harvest low.”

As supplies accumulate during harvest, prices tend to fall. This simple economic phenomenon tends to climax in October, right in the heart of harvest. Traders tend to sell beans when supply is at its highest. As harvest progresses through October and November, traders begin to anticipate forward sales, which will once again begin to whittle down supply. Thus, it is not uncommon to see a price low in October followed by a steady rally into the new year.

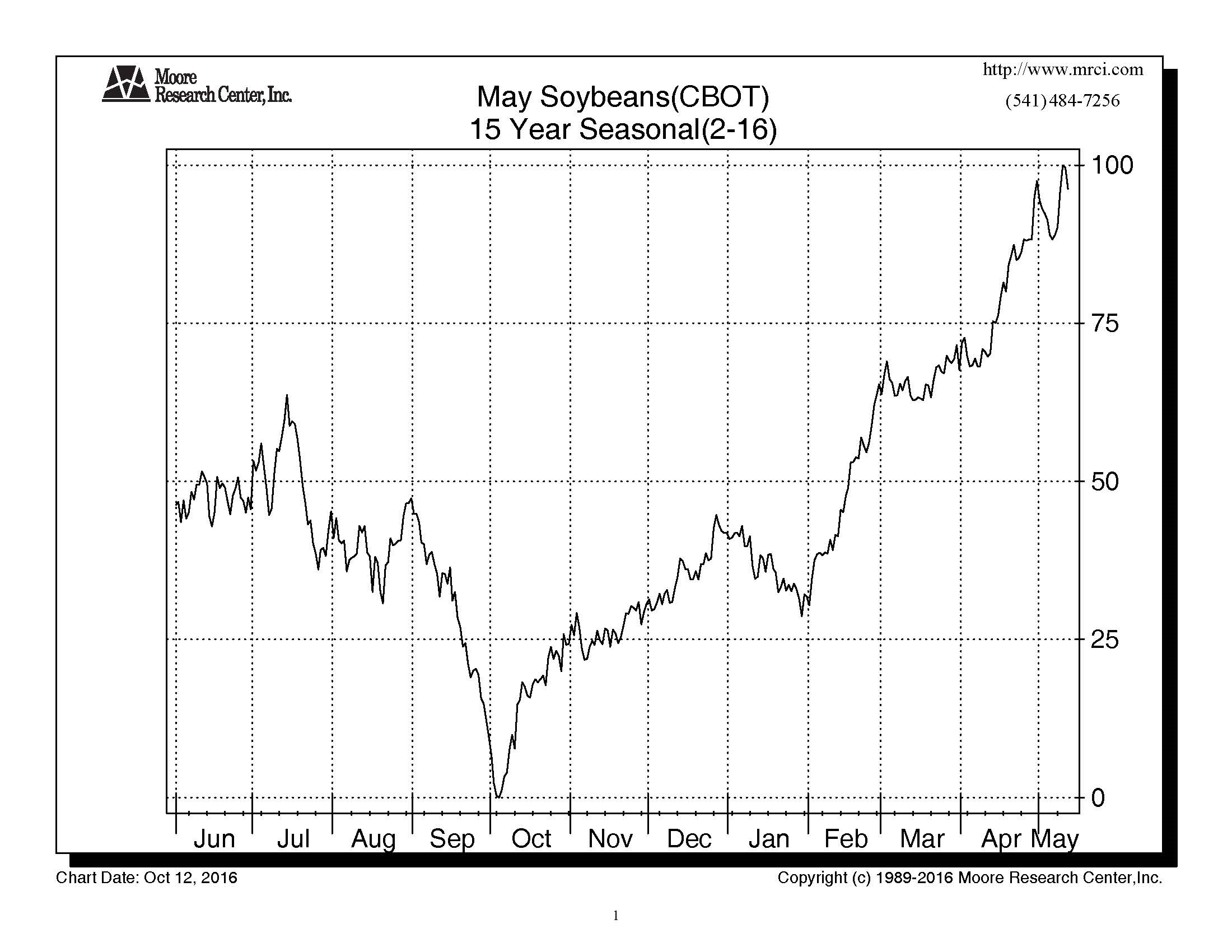

This tendency is illustrated in the chart below.

May Soybean 15 Year Seasonal

Soybean prices have historically tended to decline into harvest (October), when supplies will be at their peak. But by November, traders are already anticipating forward sales – often a supporter of prices.

But…Supplies Still Burdonsome

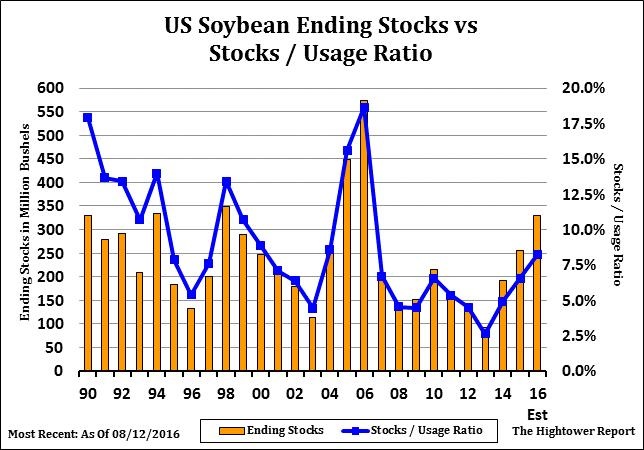

While bullish traders wait for a seasonal bottom in the soybean market as an opportunity to buy, the USDA may be throwing water on their campfire. In its monthly supply/demand report on October 12, the USDA raised 2016/17 US Soybean ending stocks to 395 million bushels – the highest in a decade and a 12% increase over last month’s estimate. The price critical stocks to usage ratio is also at its highest in a decade.

On October 12, the USDA raised 2016/17 soybean ending stocks to 395 million bushels – the highest in a decade. But it was not the bigger surge in supply some were expecting.

Ending stocks are a key, if not they key measure of supply in grain markets. (To learn more about using ending stocks and stocks to usage figures to project grain prices, watch Michael Gross’ excellent video lesson – Agricultural Fundamentals for Beginners.)

The October report is a big one because it is the first supply demand report that has real harvest figures from the 2016 crop to go on (rather than estimates). It sets the tone for the rest of harvest. While 395 is a bearish figure for sure, it is not as bearish as some had projected. Some in the trade had ending stocks pegged as high as 517 million bushels – which would almost certainly have sent prices tumbling to another level.

As it is, prices will still likely probe for a seasonal low in October. But we don’t expect the washout some had forecast.

Conclusion and Strategy

With Ending stocks raised to 395 million bushels in the latest USDA report, the bearish supply picture will be in place for some time in the soybean market.

At the same time, beans appear to have escaped the cataclysmic supply build predicted by some prior to the USDA’s report.

This sets the table for a post-harvest price rally in soybeans as is the historical price tendency.

Tendencies however, are just that. There is no guarantee that soybean prices will set sail on a bullish recovery into Spring. In fact, with the highest ending stocks in 10 years, we expect rallies to be tempered.

Thus, this balancing effect between a seasonal price tendency higher and downward pressure from excess supply could create a perfect storm of its own – for option writers.

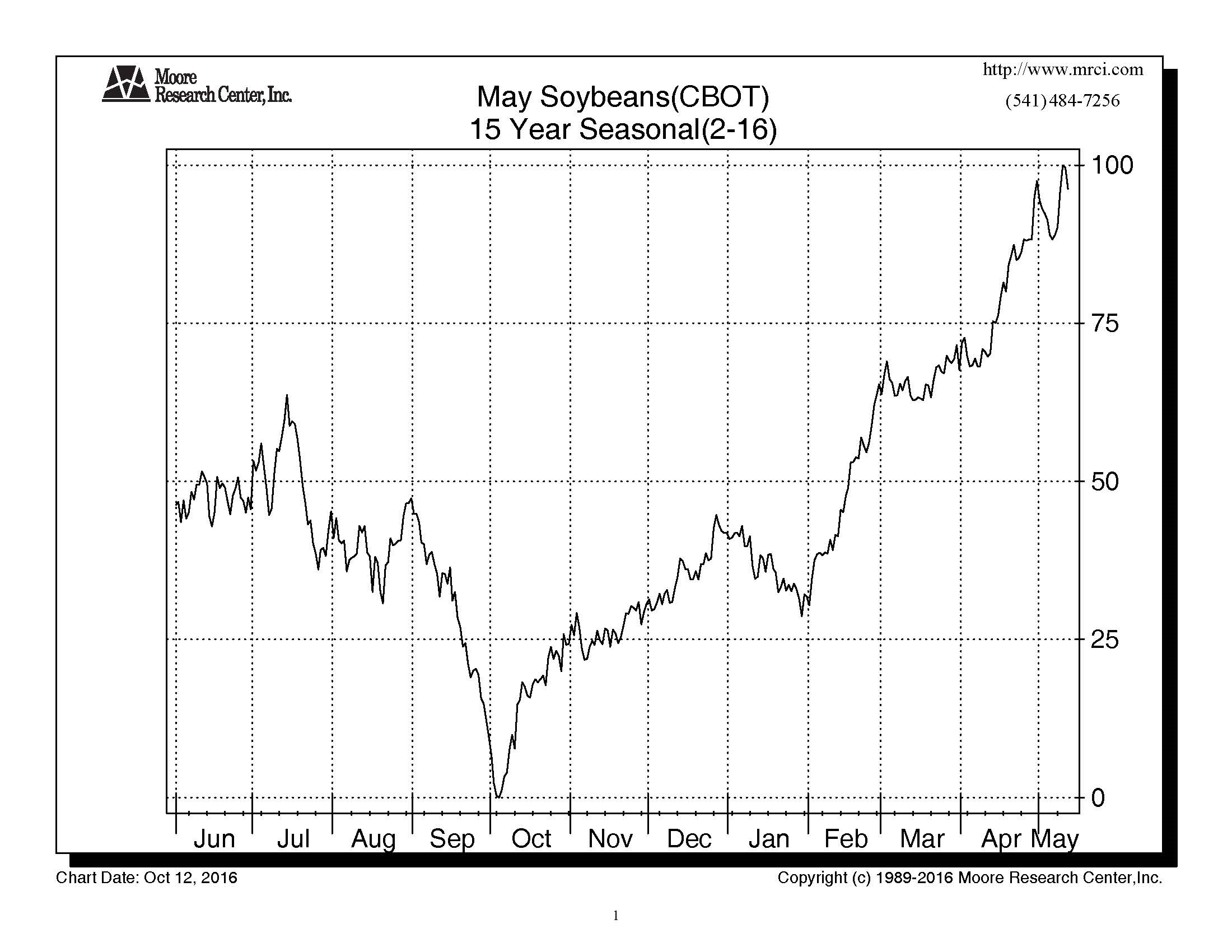

Such a scenario creates the ideal environment for an option strangle. A strangle is the strategy of selling a put below the market and a call above the market – simultaneously. If the price of soybeans is anywhere between the two strikes at expiration, both options expire worthless and you keep both of the premiums.

Strangles can offer you a more stable trade as gains in the put can offset a temporary loss on the call – and vice versa. But strangles also offer the opportunity for higher ROI’s – which means bigger gains for you if the trade is successful. You can learn more about strangles in our instructional video at www.OptionSellers.com/Strangle.

We’ll be working closely with client accounts during the month of October to identify opportunities for selling option strangles in the soybean markets.

Non-clients can consider the May Soybean 11.60 call/8.40 put strangle for a total premium of $800 per strangle. Margin per strangle is approximately $1450.

May 2017 Soybeans

May soybean option strangle showing 11.60 and 8.40 strike prices. If the price of soybeans is anywhere between the two strikes at option expiration, both expire worthless and the seller keeps both premiums. In the meantime, fluctuations in the premiums tend to balance each other.

Option strangles are the optimal strategy for profiting from markets with mixed fundamentals. And for those seeking diversification, this gets you far away from any October surprises in the S&P.

If you learn to invest properly in uncorrelated assets, October or any other month won’t have to be so scary anymore.

For more information on managed commodity option selling portfolios with James Cordier and OptionSellers.com visit www.OptionSellers.com/Discovery to get a Free Investor Discovery Pack (Recommended Investment US $1 MM).