THIS WEEK AND THROUGH NOVEMBER

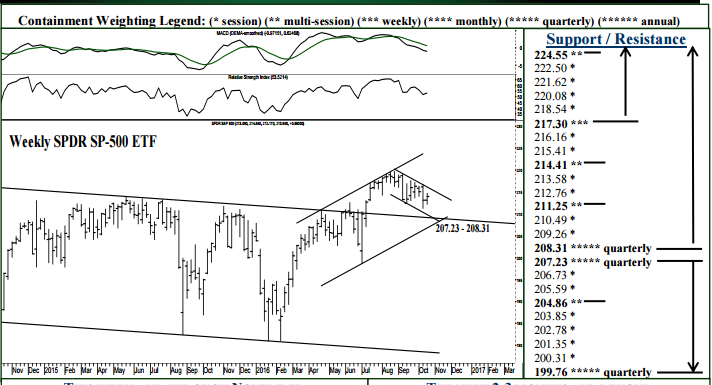

For the week ahead, both 211.25 and 214.41 can contain activity into later week, within which a two-sided dynamic continues over this time horizon. An daily settlement early in the week outside this region should yield the next meaningful area by Friday’s close. Upside, a daily settlement above 214.41 signals 217.30 within 3-5 days where SPY can top out through next week. A weekly settlement Friday above 217.30 sustains a bullish dynamic into December, 224.55 then expected within 1-2 weeks, the 231.76-33.29 region attainable by the end of the year where the SPY should top out through Q1. Downside this week, a daily settlement below 211.25 indicates a 3-5 day collapse into the 207.23-208.31 region where the market can bottom out through Q1 – and above which it remains poised for upward continuation into later 2017. A surprise settlement this week below 207.23 indicates a good 2016 high, 199.76 then becoming 3-5 week target.

THE NEXT 2-3 MONTHS AND BEYOND

The 207.23 – 208.31 region can absorb selling through the balance of the year, above which a secondary long-term buy signals remains in effect, expecting 231.76-233.29 within 3-5 months, the next 8-12 months likely to reach an ascending long-term channel top currently at 244.50, where the SPY should top out on an annual basis (top of page 2). Downside, a weekly settlement Friday back below 207.23 would scream “failed long-term buy signal”, essentially a valid sell signal over the next 3-5 weeks into the 199.76 region where the market should bottom out through the balance of the year. Nonetheless, by closing the week below 207.23 the SPY opens itself up to market-collapse over the following 3-5 months into the 183.88 region, long-term support expected to contain selling through 2017 (if tested).

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE