Like the battle between the Chicago Cubs and Cleveland Indians, the stock market indices of the S&P 500 (SPX) and the Nasdaq 100 (NDX) are opposing each other to determine the near-term direction of the stock market.

Click here to watch a video explaining how to read markets using volume at price.

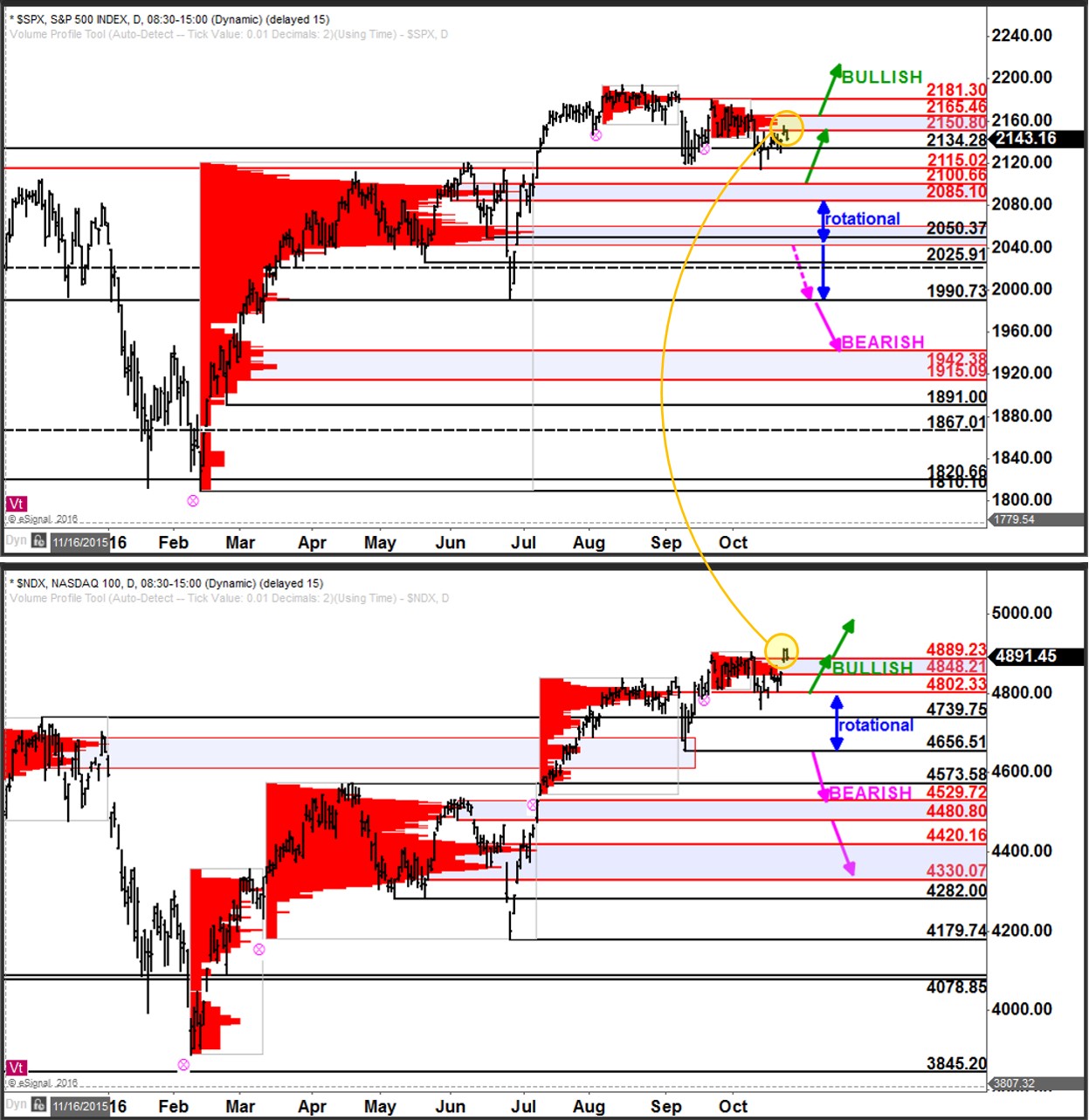

The SPX is testing resistance and finding selling pressure at 2150 – 2165, an area defined as resistance by the high-volume area of late-Sept and early-Oct.

The NDX has broken above what was resistance at its equivalent high-volume area at 4848 – 4889 and this zone is now support.

So, either the SPX is going to succeed in breaking higher and join the NDX on the upside or the NDX is going to lose its wings and get dragged lower if selling pressure continues in the SPX.

With the NDX maintaining above support for the last 2 days and the SPX remaining below resistance for the last 2 days, it’s hard to tell who’s leading this series. But keep an eye out for the winner. It will likely result in determining the market’s next leg higher or lower depending on the outcome.