SHORT-TERM (today and 5 days out)

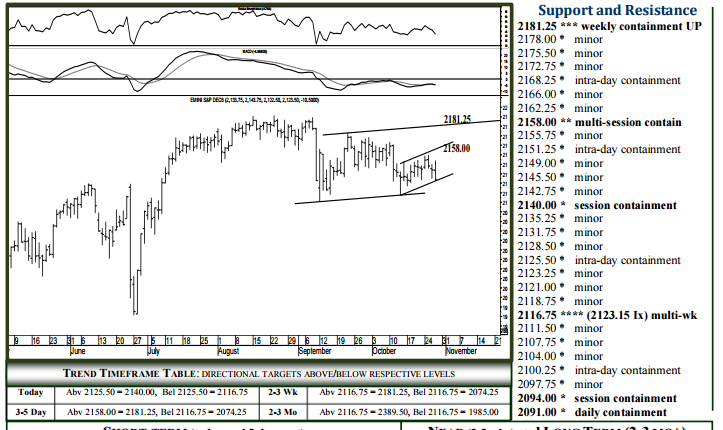

For Friday, 2125.50 can contain initial weakness (assuming an open above), 2140.00 in reach and able to contain session strength. Pushing through 2140.00 allows 2151.25 intraday, while closing above 2140.00 signals 2158.00 on Monday, the 2181.25 formation attainable by the end of next week – likely to contain weekly buying pressures when tested and a meaningful upside continuation point into later November. Downside Friday, breaking/opening below 2125.50 signals 2116.75 (2123.15 index), able to contain selling through the balance of the year and above which a secondary long-term buy signal remains in effect, expecting 2181.25 by mid-November, higher price levels expected into December activity. Breaking (opening?) below 2116.75 should yield at least 2100.25, possibly 2094.00 intraday, while closing today below 2116.75 indicates 2074.25 by the end of next week, 1985.00 attainable within 3-5 weeks

NEAR (2-3 wks) and LONG TERM (2-3 MO+)

The 2116.75 (2123.15 index – page 2) level can absorb selling through the balance of the year and above which a secondary long-term buy signal remains in effect, expecting 2233.25 within 3-5 weeks, 2389.50 within 5-8 months. On the other hand, a daily settlement below 2116.75 indicates a good 2016 high, 2074.25 then considered a 1-2 week target, 1985.00 attainable within 3-5 weeks where the market can bottom out through the balance of the year. Nonetheless, such a settlement below 2116.75 would represent significant buysignal-failure, allowing bearish continuation over the next 3-5 months into the 1832.25 region – this potential downside target essentially confirmed following violation of 1980.50.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE