It seems as if there is a lot of uncertainty in the World at current times. On the Geopolitical front, you have the looming U.S. presidential elections, European elections next year as well as the continuing uncertainty over Brexit. On the economic front, there are general concerns about the pace of China’s growth (the most powerful engine recently).

With all of these uncertainties, people are generally looking for assets that can protect their portfolios. To a skilled trader with solid determination, these times of general worry can be turned into a profitable trading opportunity.

In this post, we will look into a few safe haven assets, which could make for a profitable trade over the next few weeks.

Go for Gold

It is almost the go-to asset in times of uncertainty. Ever since the times of high inflation in the mid 70s, Gold has been seen as a store of value. As an indicator of just how it is viewed in the public’s eye, below is the Google trends graph for the search term “Gold as an investment” in the U.K. As one can see, there is a considerable spike in the search traffic immediately prior to brexit. The same can be said for the investment community as on the day of the vote, Gold spiked considerably and reached a yearly high. For a shrewd trader, taking advantage of Gold’s volatility can be incredibly profitable.

Obviously, taking a view on a Binary outcome such as an election is a trade that can be one-sided and more risky. Hence, if you are thinking of going long gold before an important event (such as the U.S election), it is more prudent to monitor the downside. This is where option strategies come into their own. An investor can enter a spread trade on a CALL and a PUT option and hence benefit from volatility in the price.

However, when looking at it from a technical perspective, Gold tends to follow chart patterns well and is one of the favorite assets of technical analysts. Looking at the chart below, one can see that Spot Gold is presenting all the bullish indicators. It is trending in a positive direction with high volume and positive momentum. Of course, the trader needs to take into account that the above trend could adjust should a favorable outcome in the U.S. election materialize (Clinton win). Hence, it would be wise to go long Spot gold but have a trailing stop to lock in any profits. Of course, an investor could also choose to enter a Binary CALL option with expiry immediately prior to the election.

It is important to not forget that Gold is indeed a physical asset and general physical supply and demand forces are always at play. However, in current times, the investment demands are by far the largest.

Trade the Fear Index (VIX)

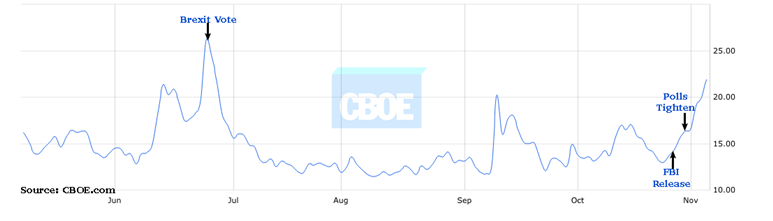

In a recent post, I introduced the VIX volatility index and went through some Binary Option trade ideas. The VIX is a measure of the implied volatility of options on the S&P 500 stock index. It is therefore a good measure of the fear inherent in the equity market.

As we pointed out previously with regards to Brexit, the index tends to spike immediately prior to an important event. There has been a considerable spike in the VIX over the past few weeks as large investors have been looking to protect their portfolios from a potential Trump election.

As one can see from the chart below, the VIX index is at the highest point it has been since the Brexit vote in June. You can also track the increase in the index to important announcements regarding the election campaign such as poll numbers and particular announcements (October surprises). Given that the VIX is an indication of implied and forward-looking volatility, it is less responsive to massive moves in realized volatilty. Hence, it is less applicable to a trade immediately post a binary event. We saw the VIX fall immediately after the Brexit vote. However, with 2 days to go at the time of this writing, there is still opportunity to take advantage of VIX increases as more investors buy option protection prior to the election.

Buy Bitcoin

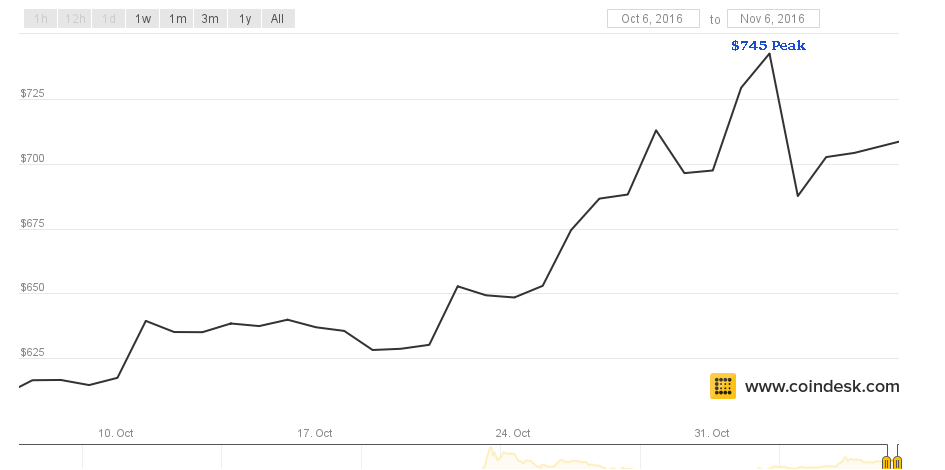

For most traders, Bitcoin is a relatively new and less predictable asset to trade. One cannot, however discount it’s safe haven status. This can be said not only for market uncertainty but as an inflation hedge. Given that is a crypto currency that naturally has a limited supply because of the Blockchain, some consider it a superior to FIAT currencies.

Currently, Bitcoin trading volumes reached a record 47 million last week which was the highest on record. This pushed Bitcoin to a four month high of $745 on Wednesday.

This is mainly been driven by demand from Chinese investors. These investors are looking for a hedge against a falling Chinese Yuan. However, there is no doubt that Bitcoin could indeed spike if Trump were elected. As investors become aware of the impact of potential trade wars on the value of the dollar, they will start jumping on the crypto-currency bandwagon. Given that Bitcoin is also easily available to the retail market on various exchanges, there is a possibility of a panic to purchase prior to an unexpected result.

Hence, when watching the state by state election announcements on Tuesday evening, monitor your Bitcoin trades and position yourself for any potential short term surprises.