Follow these Advanced and Counterintuitive guidelines and watch your Portfolio Thrive in a Trump White House

By the time you read this, the 2016 Election Season will finally, mercifully, be over.

The season is reminiscent of the old farmer/raccoon story where the farmer trees a coon behind his barn and can’t seem to bring it out of the tree. So he puts down his shotgun and climbs up into the tree to fell the animal by hand. Upon his arrival, he discovers, much to his dismay, that the “coon” is actually a bobcat. A horrible ruckus ensues. The farmer’s sons, hearing the commotion, race down to the tree with their shotguns in hand. Hearing both the wounded cries of the farmer and the cat, the young men are unsure where to shoot, fearing hitting their embattled father. Finally, they hear a command from above: “Just put your fire into the tree boys! One of us has got to get some relief!” (I stole that story from a WSJ article but cannot remember the author to credit.)

Regardless of the outcome, it is a relief that it’s over. Thus the suffering of anyone who has followed this brutal, bitter, no holds barred election cycle. Not the least of which has been YOU, the high net worth investor. Whichever way you lean politically, trying to guess how markets will react to victories by either candidate can keep an investor up at night.

Thus a favorite subject of financial media is how will a victory by Trump or Clinton affect the markets? Will a victory by either candidate be “good” or “bad” for stocks?

A reporter called me just this week to ask if a Clinton victory would be “good” or “bad” for commodities.

Now there are two answers to this question. One is the short, easy, concise answer that the reporter wanted (which I did not give.) The other is the smart answer that makes money.

For this column, we’ll give the latter.

No such thing as “Good” or “Bad” Markets

The good news is this: THERE ARE NO “GOOD” OR “BAD” markets – only how you position in them. Traditional investors think that “good” markets are bull markets and “bad” markets are bear markets. Option sellers, especially commodities option sellers, see only bull or bear. Either can be equally profitable and just as easily reaped.

A perfect example of this is revealed in Dr. Samir Elias’s book: Generate Thousands in cash on your stocks before buying or selling them (a must read for any investor who sells, or is considering selling options.) Dr. Elias shows an enlightening example of how he made nearly $20,000 by selling calls on a collapsing Mckesson (MCK) stock, all the way to the bottom.

Most traditional investors would consider this precipitous fall in price a “bad” move for Mckesson.

It wasn’t for Dr. Elias.

And it doesn’t have to be for you. “Good” or “Bad” markets are a relative term. A stock market dive after the election might be “bad” for a traditional buy and hold investor. But it could be gold for an option seller – as Dr. Elias proved.

Sell Calls on the S&P?

Am I suggesting selling calls on the S&P ahead of the election?

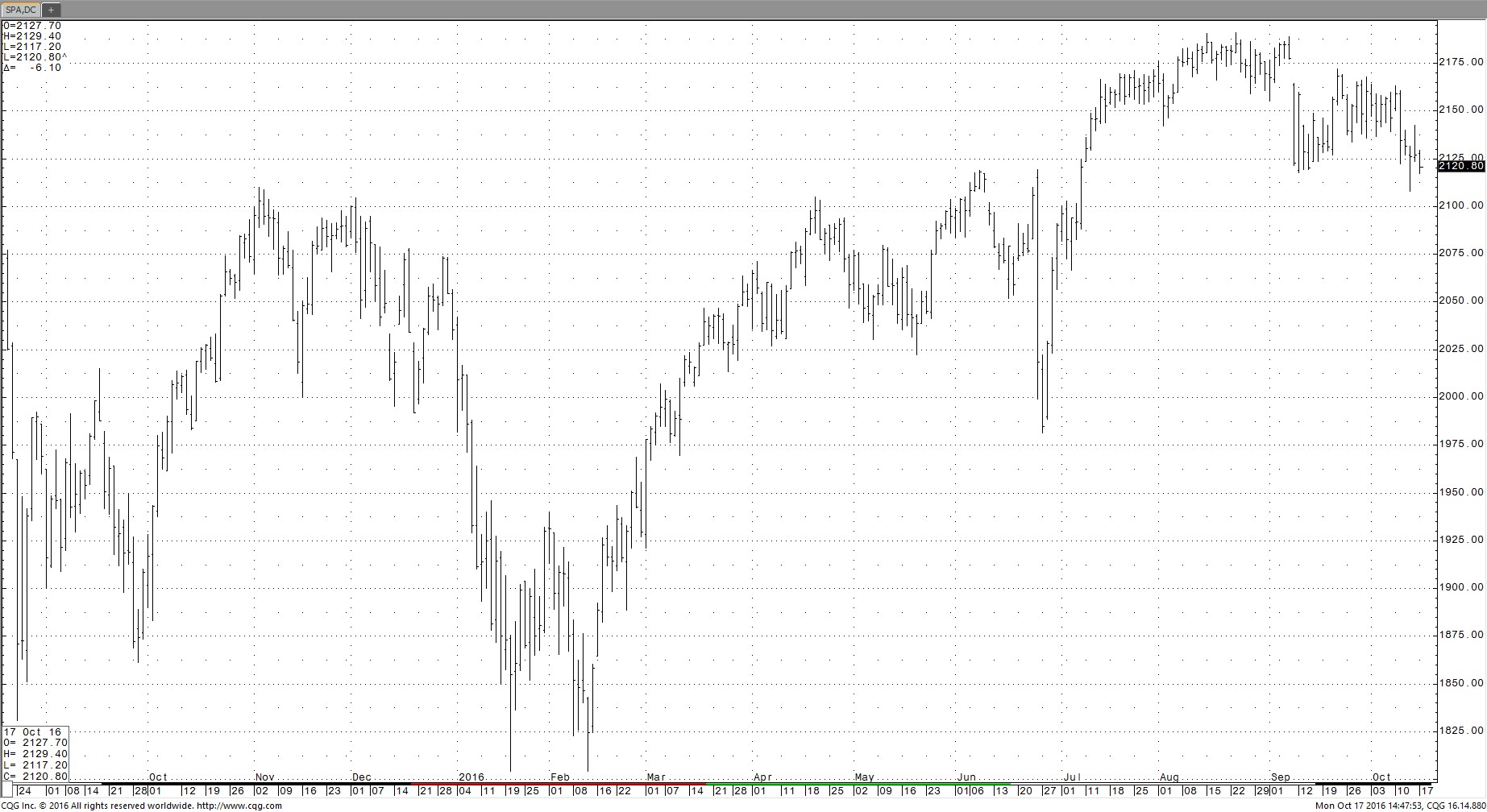

Not necessarily. Then again, that chart looks pretty ominous.

However, I gave up trying to trade the stock market years ago. Price discovery in stocks has so many moving parts it simply makes no sense to me when or why it moves.

S&P 500

Ready to roll over? Maybe. But commodities may offer more logical reasons to buy or sell.

I prefer something that at least has some logic to it – which is why I chose commodities.

Back to the point, if you are the kind of investor who wishes to try to guess

1. Who will win the election

and

2. How “the market” will react to that outcome

…feel free to have at it. But that is not investing. “Good” or “bad” outcome, you’re simply gambling.

It is possible that stocks will have already “priced in” a winner by the time of the actual election and thus see a muted reaction afterwards. But should stocks surge or purge, it will likely be a short lived “knee jerk” reaction.

Smart investors will be best served by planning for the next 4 years, not the next 4 weeks. This month, you’ll learn our 5 rules for maximizing your asset growth over that time, regardless of who sits in the Oval Office.

Surviving and Thriving in the next 4 Years

“Good” or “Bad” markets the next four years, you can survive a Hillary (or Trump) presidency in style by targeting high returns in your portfolio. How? By employing these advanced and sometimes counter-intuitive investing rules:

5 Rules for Consistent Asset Growth in the Next 4 Year

Seek Real Diversification: Not just more stocks or stock options. Get 5-45% of your investment assets into alternative, uncorrelated, non-traditional asset classes. Not doing this is the #1 mistake of high net worth investors and could dangerous to your net worth if stocks head south.

Adopt Alternative Strategies: Diversify not just your asset class, but investment strategies. Adopt approaches that can excel in bull or bear markets. We’re bound to see both over the next 48 months in stocks, bonds or commodities. Doing this can allow you to potentially generate returns whether the economy, interest rates or taxes move up, down or stay the same.

Make sure it’s a real “Asset.” Robert Kiyosaki, author of the “Rich Dad, Poor Dad” series of books, defines an asset as “something that puts cash in your pocket – not takes it out.” Thus buying something for appreciation alone (like a stock or an option) would not qualify under Bob’s definition. Real Estate with monthly cash flow, a stock that pays dividends, selling an option that pays premium up front – all would qualify under this definition.

Look for NEW tax advantaged strategies and investments. As a “1% er,” you are a tax target of the Federal government. And while one candidate is likely going to hit you harder than the other (you know who), minimizing your tax bite will be a paramount concern either way. Muni’s are the traditional favorite. But there are alternatives out there that you may have never considered. Tax liability can have a huge impact on end of year net return.

Consider Hired Guns: In The Magnificent Seven (the 1960 original is much, much better than the remake – trust me) townspeople under siege hire a group of gunslingers to help them face down a brutal land baron. It works. The landscape of modern investing, especially alternative investing, can be like the Wild West. The next 4 years will likely make it more so. This is particularly true for high net worth investors who may desire the diversification and potentially

Bringing in hired guns can be a smart move in unfamiliar asset classes

higher returns of alternatives, but lack the time or expertise to trade themselves. Bringing in specialized expertise to handle these can add percentage points to your end of year asset growth. But screen carefully. For every Yul Brynner, there are 5 Don Knotts seeking to join your posse. Screening to separate wheat from chaff is time consuming. At the end of the next 1, 5 or 10 years, it will be well worth the few hours of interview screenings.

For clients of my firm, I strive to create portfolios that hit all 5 of these bases. However, if you’re not yet a client, you can get more information on this type of portfolio at www.OptionSellers.com/Discovery.

Breathe a sigh of relief – it’s almost over! Let’s get on with making money already.

James Cordier is author of McGraw-Hill’s The Complete Guide to Option Selling, 3rd Edition and head portfolio manager at OptionSellers.com – a wealth advisory firm specializing in option writing portfolios for high net worth investors. James’ trademarked Premium Sniper investment program has been used by elite investors from the US, Australia, the United Kingdom, Singapore, Malaysia and Dubai. For more information visit www.OptionSellers.com/Discovery.