OK I’ll admit, to my knowledge Mark Twain never famously said, “Buy the dip.” He is however, often credited with the quip, “History doesn’t repeat itself but it often rhymes.”

This statement is very true when considering financial markets. Let me show you how the current market rhymes with the last multi-month ‘buy the dip’ market phase.

Click here to watch a video explaining how to read markets using volume at price.

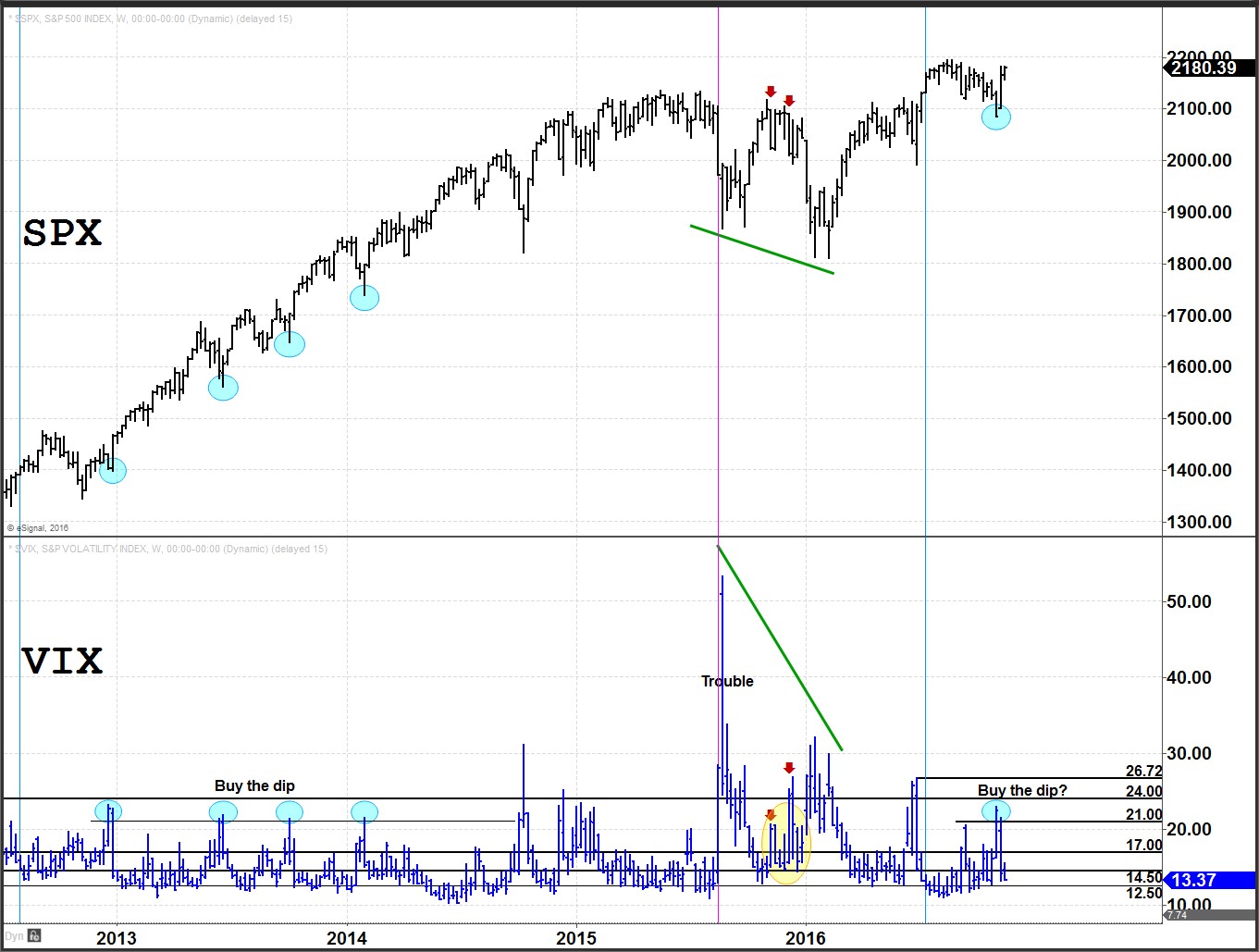

Look at the following chart. The upper panel is showing the S&P 500 index (SPX). The lower panel is showing the VIX. If you look back to the period of 2013 and 2014, you can see that over the course of that extended rally, each time the SPX dipped and VIX perked up into the 21 – 24 range, it marked an excellent buying opportunity (highlighted blue circles).

Looking to today, the positioning of the SPX as well as the action in the VIX is suggestive that we may be entering into a new ‘buy the dip’ market phase. The most recent spike into the 21 – 24 range by the VIX marked an excellent buying opportunity. Following the brief spike in VIX, the SPX responded immediately to the upside and the VIX quickly retreated back below 14.50. This type of action in the SPX and VIX rhymes with the prior buy-the-dip period from 2013 – 2014.