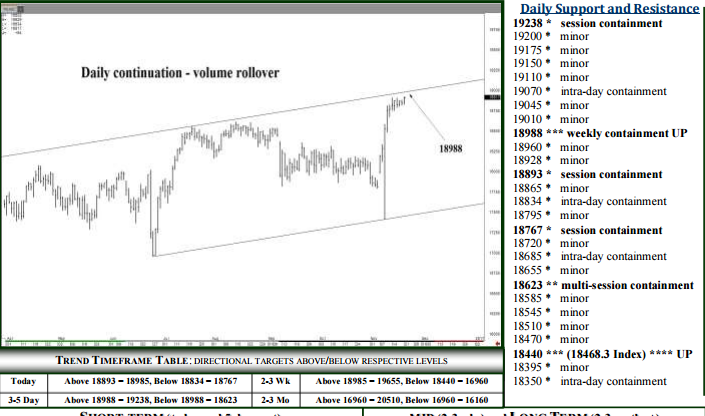

SHORT-TERM (today and 5 days out) For Tuesday, the 18988 formation can absorb weekly buying pressures, once tested 18440 attainable within several weeks. Downside today, 18893 can contain session weakness, while breaking/opening below 18893 allows 18834, possibly 18767 intraday, also able to contain session weakness and the level to settle below for indicating a good weekly high, 18623 then considered a 2-3 day target. Upside today, pushing/opening above 18988 allows 19070 intraday, while closing today above 18988 maintains a bullish dynamic into later December, 19238 then considered a 3-5 day target, 19655 expected within several weeks.

MID (2-3 wks) and LONG TERM (2-3 mnths +) The 18440 (18471.5 index – page 2) level can absorb selling through December, above which 19655 remains a 5-8 week target likely to contain strength through Q1. Closing above 19655 indicates 20510 within several months where the Dow can top out through 2017. Downside, a daily settlement below 18440 should yield 16960 within several weeks, able to contain selling through January and the level to settle above for indicating bearish trade into later Q1 – longer-term support at 16140 then considered a 3-5 week able to contain selling into mid-2017.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE