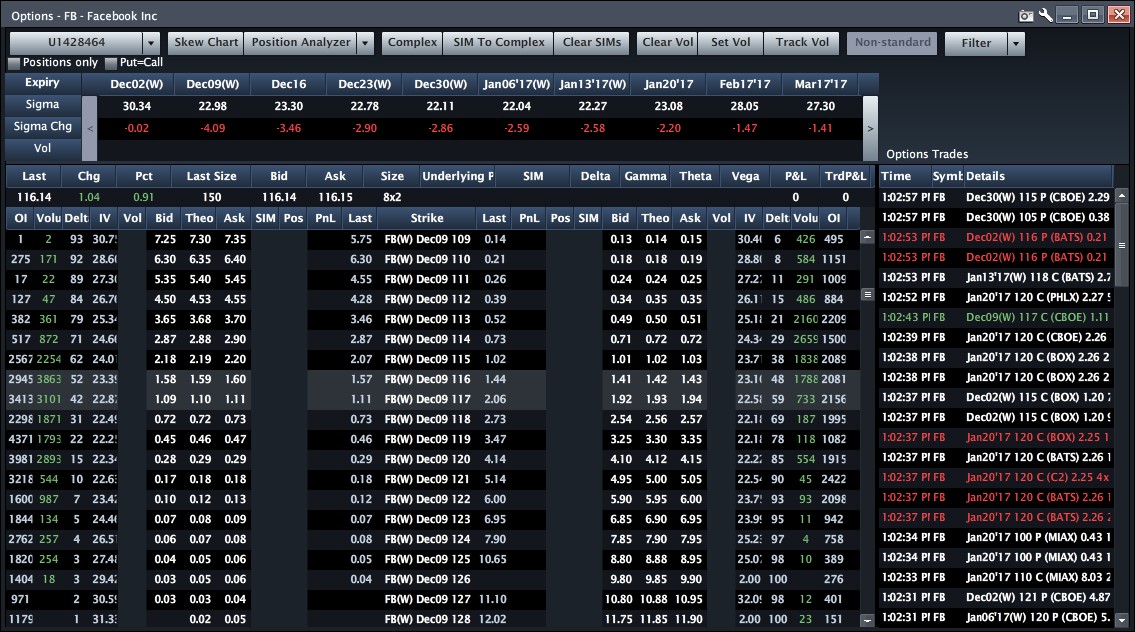

Early assignment. It’s not a phrase any options trader wants to hear. It strikes fear in the hearts of many, but if you are armed with the facts, there’s nothing to fear. First off, what is “early assignment”? Simple, it occurs when one is short (the seller) of an (American-style) option and the counter-party (the owner of the option) invokes his or her right to exercise that option before the option’s expiration. I do specify “American-style” because there are some options that are not “American-style”, like VIX options. For our purposes, any equity, ETF or futures settled option is “American-style”. The important thing to realize is that the only time that warrants early exercise is when the extrinsic value of the option is zero. The most direct way to determine when the extrinsic value of an in-the-money option is zero is to look at the corresponding out-of-the-money option. Let’s us the following example in Facebook (FB):

So, we are considering weekly options for December 9th. Facebook is presently trading $116.16. Let’s say that we are short the 109 calls expiring on December 9th. One might be concerned that they are at risk for early assignment. Why would someone who is long the 109 calls with only about a week left to expiration not exercise their option to get long at 109 when FB is trading $116.16? I am not saying they are not in a good position but what I am saying is that they are leaving money on the table. In this case, we can look at the 109 put which is trading $0.14 presently. If they exercise their call, they simply get long FB at a price of 109. If they just sell out their call option, they take in the intrinsic value of the call (116.16 – 109 = 10.16) plus the $0.14 of extrinsic value as well. So, when/if that out-of-the-money put has zero value left, one is at risk for early exercise. Until that happens, it is highly unlikely that an early assignment will occur.