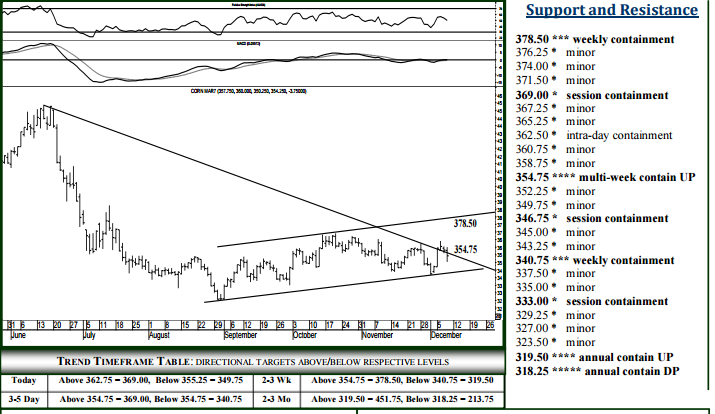

SHORT-TERM (TODAY AND 5 DAYS OUT)

For Friday, 354.75 can contain strength through the balance of December, below which the market is now vulnerable to retesting long-term support at 319.50 over the next 3-5 weeks (page 2). Downside today, 346.75 can contain session weakness, while closing today below 346.75 indicates 340.75 within 1-2 days, able to contain selling through next week and the level to settle below for accelerating the 319.50 “target” to within 1-2 weeks. Upside today, pushing/opening above 354.75 allows 362.50 intraday, while closing today above 354.75 presents a neutral – constructive dynamic into later December, 378.50 then attaianble within several weeks.

MID (2-3 WKS) AND LONG-TERM (2-3 MO’S)

The 354.75 level can absorb buying through the balance of December trade, below which 319.50 is attainable over the next 3-5 weeks. Downside, 340.75 can contain weekly selling pressures when tested, with a daily settlement below 340.75 expected to yield 319.50 within 1-2 weeks with a broader complex can bottom out through 2017 and above which 451.75 remains a 5- 8 month target (page 2). Upside, a settlement back about 354.25 presents a more constructive dynamic into later December, 378.50 then considered a 2-3 week objective, 404.25 attainable within 3-5 weeks where the