In a similar article that I authored this time last year “3 Stocks With The Most Turnaround Potential in 2016”), I laid out my theses for three beaten-down stocks that I believed with turn around and outperform the S&P 500 this year. The three stocks that I discussed were: Coach (COH), Urban Outfitters (URB), and Stillwater Mining (SWC). On a year-to-date basis, these three stocks are up by +21%, +42%, and +99%, respectively.

Every day I run a screen to find beaten-down stocks that I believe could outperform the market over the next 12 months. My own 20 years of trading experience tells me that buying a stock whose price has been falling is akin to “catching a falling knife,” as momentum tends to be a consistent factor that has outperformed value-based and passive strategies. Moreover, the empirical evidence shows that negative price momentum in stocks has more persistence than positive momentum. This means a short-selling strategy based on shorting stocks that have gone down the most (hedged with a long position in the S&P 500) tend to outperform a (hedged) strategy focused on buying stocks that have gone up the most.

Such momentum biases, however, tend to last only for 12 months or so, as the empirical evidence also shows the existence of a “reversal effect” after 3 to 5 years. This means one could outperform the market by buying beaten-down stocks that have consistently underperformed the market over the last 3 to 5 years.

With U.S. stock valuations now at their highest level since the technology bubble, I believe the S&P 500 will earn a zero or even a negative return next year. As such, I don’t have a particularly strong conviction on picking any turnaround U.S. stocks this year.

In lieu of a stock pick, my candidate for the investment with the most turnaround potential in 2017 is gold. Using the gold ETF, GLD, as a proxy, gold is still up 7% on a year-to-date basis. However, the yellow metal is still down by an annualized 3% and 7% over the last three and five years, respectively. After enduring a bear market since peaking at $1,900 an ounce in September 2011, I believe gold bottomed at $1,050 an ounce in December 2015 and is now in a sustained uptrend. Here are the reasons why I like gold at the current price of $1,150 an ounce.

1. Highly inflationary U.S. and Chinese policies resulting in speculative fund flows into gold

President-elect Trump’s plans to cut taxes is estimated to add $7.2 trillion to the federal debt in the first decade and as much as $20.9 trillion by 2036, on top of the $19 trillion outstanding today. Even in the absence of such additional spending (Congress has never been able to implement a “revenue-neutral” tax cut in the modern era), U.S. federal debt is still expected to increase from 77% of U.S. GDP at year-end 2016 to 86%, or about $23 trillion, over the next decade, driven by entitlement spending such as Social Security and Medicare/Medicaid. Higher fiscal spending in the context of a tight labor market and rising wage growth invariably leads to higher inflation.

Similarly, the ongoing fiscal stimuli and a surging housing market has led to significant credit creation in China. The most recent surge in housing prices began in April 2015 as Chinese stock prices were tracing out a peak; a similar peak is being traced out in the Chinese housing market today as regulators institute macroprudential policies to prick the Chinese housing bubble. Chinese speculators are now turning to the commodities market to hedge the depreciation in their Chinese yuan-denominated assets. Over the last three months, zinc and copper prices, for example, have risen by 20% and 25%, respectively, driven by Chinese buying. Finally, gold futures turnover in China has risen to about 25% of that on the Chicago Mercantile Exchange, suggesting that precious metals pricing power is increasingly shifting to Chinese hedge funds and traders

2. Chinese and Indian jewelry demand to recover in 2017

According to the World Gold Council, global jewelry demand, which makes up 50% of annual gold demand, was down 21% year-over-year during Q3 2016. This was driven by an unprecedented decline in jewelry demand in the world’s two largest markets, China and India (which collectively account for 60% of global jewelry demand), where jewelry consumption was down 27% and 41%, respectively, year-over-year. Jewelry demand is expected to hit a seven-year low in China, and a 13-year low in India.

This year’s unprecedented weakness of the Chinese and Indian jewelry markets was due to a confluence of factors which would not repeat in 2017. These include: 1) a loss of Chinese consumer confidence, 2) Chinese gold import curbs designed to restrict capital flight, 3) a tax hike on Indian gold imports earlier this year, 4) a cash crisis in India as the country’s government outlawed the use of large-denomination notes. With the recent correction in gold prices, I expect both Chinese and Indian consumers to step up their jewelry purchases in 2017. Already, a large Hong Kong-based retailer, Wo Shing Goldsmith, is reporting a 20%-25% rise in gold jewelry sales over the past month.

3. Speculative inflows into the GLD ETF have capitulated, suggesting a good entry point

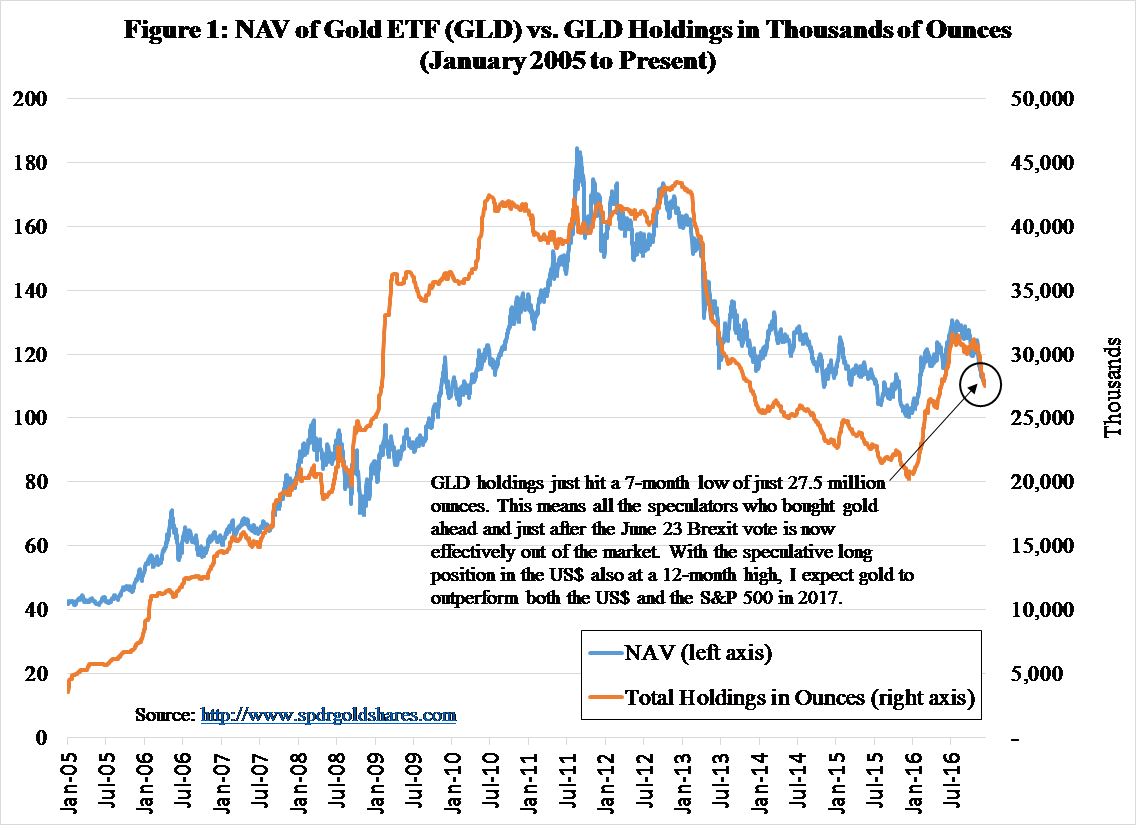

In the month leading into and in the immediate aftermath of the June 23 Brexit vote, GLD’s holdings increased by 3.7 million ounces, or 13%, to a total of 31.6 million ounces as retail investors scrambled into gold over fears of a potential breakup of the European Union. Since then, GLD’s holdings have declined by 4.1 million ounces (see Figure 1 below) to a total of 27.5 million ounces, a seven-month low. This means much of the Brexit-related “hot money” has gotten out and capitulated on gold. From a contrarian and trading standpoint, today’s price of $1,150 an ounce is thus a good entry point.

Disclosure: I, and my firm, CB Capital Partners, currently hold shares in GLD.

Bio:

Henry To, CFA, CAIA, FRM is Partner & Chief Investment Officer at CB Capital Partners. Established in 2001, CB Capital Partners is a global financial advisory and investment firm headquartered in Newport Beach, California, with offices in Dallas, Texas, and Shanghai, China. Visit http://www.cbcapital.com and http://www.cbcapitalresearch.com for more information.