2016 was a difficult year for biotech stocks, Hilary Clinton started the ball rolling with a tweet about clamping down on price gouging back in September 2015 and the industry has never been the same. Valeant , Mylan (epi-pens) and Turing became political hot potatoes in the presidential campaign. As I am writing this President Elect Trump is has just tweeted drugmakers are ‘getting away with murder.’

But against this uncertain background I am going to suggest you hold your noise and buy this stock – and I believe you will thank me by the end of the year.

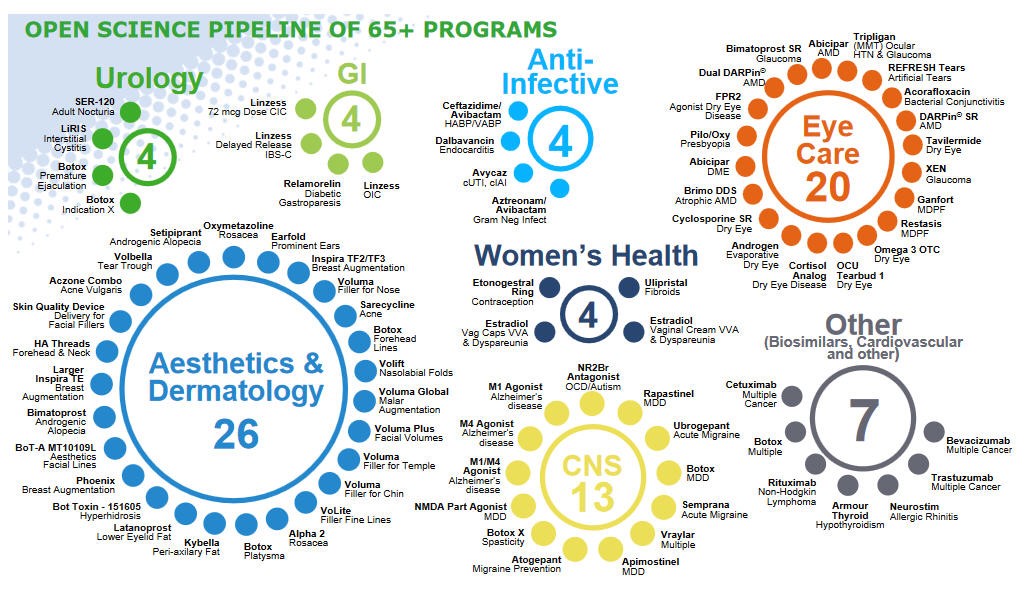

The Stock is Allergan (AGN) best known as the makers of Botox they have a diverse platform of products that provide treatments for the central nervous system, gastroenterology, women’s health and urology, ophthalmology, neurosciences, medical aesthetics, liver disease, inflammation, fibrosis, and HIV, as well as dermatology and plastic surgery, and Alzheimer’s disease. The company has also built up an impressive exposure to nonalcoholic steatohepatitis (NASH) drugs.

The company is an S&P500 stock with a market cap of US$ 80 Billion and a very nice cash pile of around 30 billion. Against this we have a forward P/E of 13 and the next set of results are out 8th February 2017 and I believe they will be solid. The company is growing a 12 to 13% annual rate so if far from stagnating.

I have owned this stock for some time and I ending up with the shares when they took over Forest Laboratories and then again when they bought out Allergan. The company was previously called Watson Pharmaceuticals and then Actavis plc before changing their name to Allergan. Allegan have a benefit of being headquartered in Dublin, Ireland which gives then a tax friendly status which of course makes it an attractive takeover candidate.

The company has a healthy pipeline which you can see here: http://allergan-web-cdn-prod.azureedge.net/actavis/actavis/media/allergan-pdf-documents/rd/allergan-open-science-product-pipeline-aug2016.pdf

Could they be taken over?

If you recall Pfizer (PFE) made a bid for them back at the end of 2015 at $363.63 a share but failed http://www.wsj.com/articles/pfizer-walks-away-from-allergan-deal-1459939739 – Today AGN are trading at $216 a share which in my view is way undervalued.

A bid could come in from either Novartis (NVS) or Merck (MRK) and I would expect it to be near the $350 level giving an a 50%+ upside, of course timing is always an issue with big deals but even without a deal just better earnings some good pipeline news can see this stock at $280 plus buy year end.

Biotech in general

As stated 2016 was a rough year for biotech the Biotech ETF XBI was down 15% against an up year for the S&P500. I do think biotech will do better this year and we should get fair amount of mergers and takeovers which will help but some focus on the sector. Even with the political worries that may weigh on drug pricing the sector has plenty of potential and should not be written off.

Trading veteran Vince Stanzione has been trading for over 30 years and has produced a home-trading course at www.fintrader.net He stresses that before you try trading it’s worth getting some training. He is also the New York Times bestselling author of The Millionaire Dropout published by Wiley.