Believe it or not, coffee prices could soon start pricing reduced summer demand. Here is how you can capitalize now.

Unlike stock analysis, commodity price forecasting is often a factor of simply getting a handle on supply and demand.

But the actual vehicle you invest in (or write options on) is a commodity futures contract. They call them futures for a reason. Futures contracts reflect what producers and consumers will likely buy or sell this product for in the future.

Thus, while studying where supply and demand are today is important, projecting where it will be 3-6-9 months from now is where the money is (or in the case of an option seller, projecting where it won’t be.)

You read and hear us speak often here about seasonal tendencies

and how important they can be to commodity option sellers. There is a reason for that. Seasonals can often hint at how prices might possibly behave in the future, based on how they reacted to similar events in the past.

For instance, grain prices can tend to decline in the fall in anticipation of higher supply (harvest). Energy prices can often rise in the Spring in anticipation of higher summer gasoline demand.

Less obvious opportunities can often lie in the soft or “exotic” commodities. One notable example this time of year is in the coffee market.

Coffee Demand Cycles: A Hidden Indicator of Price?

Seasonal tendencies can be caused by supply or demand factors that tend to occur at the same times each year.

For coffee traders, it is demand that will soon come into focus for price forecasters.

The chart below shows the top 10 coffee consuming nations in the world. 6 of the top 7 nations on this list share once characteristic in common. Can you spot it?

The geographic location of the world’s top coffee consumers can have a heavy impact on demand cycles.

It is that these 6 of the top 7 coffee consuming nations are in the northern hemisphere. In fact, 7 of the top 10 consuming nations are in the northern hemisphere. Together, these 7 nations alone account for over 54% of global coffee consumption.

Why is this important? Because coffee consumption peaks during colder, winter months and dips during warmer summer months. It’s a natural, common sense flow of supply/demand.

In fact, global coffee consumption typically dives by 12% or more during warmer summer months. In the northern hemisphere, that means June-September.

Why Target a Summer Demand Shift Now?

You might think then, that selling coffee (or coffee calls) would be a play that should wait until June.

But you would be wrong.

Futures contracts project future prices – not current prices. And there is an old saying in commodities that goes like this:

Price precedes consumption.

And by my experience, it is most often true. By the time a rise or fall in demand actually takes place, the price move reflecting that rise or fall in demand has already occurred.

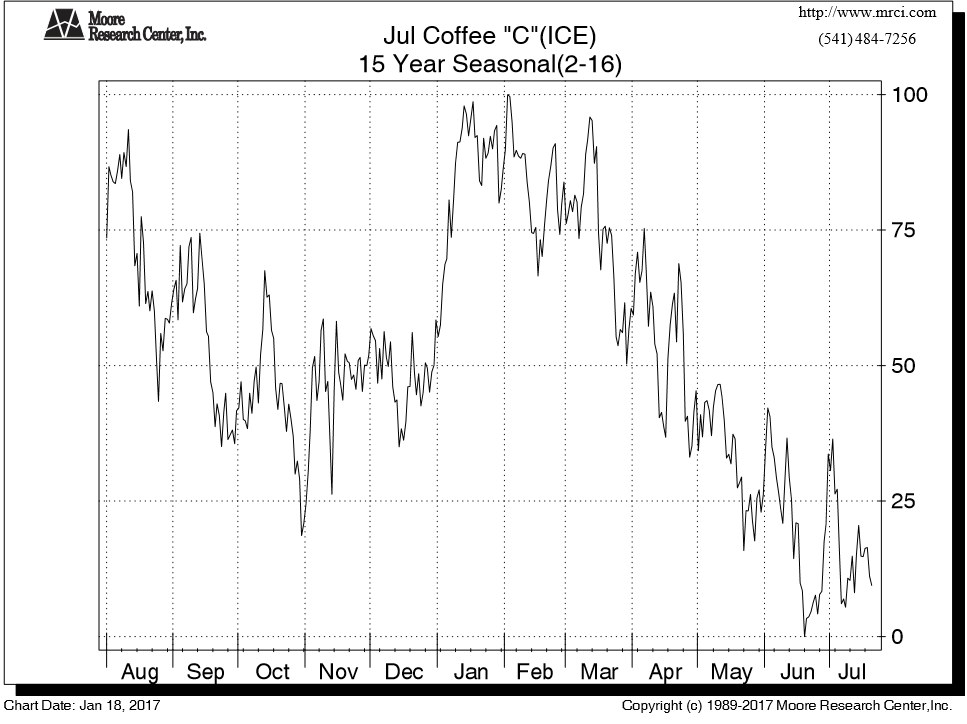

The seasonal chart for July Coffee seems to clearly indicate this.

Caption: Coffee prices have historically tended to decline in the Spring in anticipation of slower summer demand

While coffee demand at the retail level begins to decline in the Spring and hits a valley in summer, prices for summer coffee contracts have historically tended to anticipate this demand dip as early as March.

Does this mean you should sell coffee futures now? Not necessarily.

But as a seller of call options, now can be an ideal time to position.

As an option seller, you want to get out ahead of that demand curve. Premiums are higher now. And if the market rallies a bit between now and then, so what? If you’re writing premium at strikes far enough above the current market (and coffee is one market that does provide such distant strikes), it shouldn’t make much difference in most garden variety rallies.

The upside to writing call premium in the (US) winter is that it is summer in Brazil, the world’s largest producer of coffee beans. Thus, there is no fear of freezes to contend with – no risk of an unexpected frost driving a sharp price spike.

In addition, this year’s final Brazilian coffee crop is expected to yield as much as 47.5 million bags. While certainly not a record, and off slightly from last year’s 51.4 million bags, it should be more than enough to keep prices from running far beyond the 1.65 – 1.70 price level this winter.

Conclusion and Strategy

With the critical flowering season behind the Brazilian coffee crop and the potentially volatile freeze season still months ahead, the coffee market will turn its focus towards demand in the coming months.

Global coffee demand has historically dropped by as much as 12% during warmer summer months. Historically, the market has tended to begin pricing this anticipated drop in demand with lower prices as early as March.

We are positioning managed clients in coffee this month by selling a series of call options and call option spreads.