For some time now, I have wanted to publish a live Major Asset Class Relative Strength Rotation Model along the lines of an article that I posted earlier this year on the topic (see Two Simple Relative Strength Rotation Models).

For some time now, I have wanted to publish a live Major Asset Class Relative Strength Rotation Model along the lines of an article that I posted earlier this year on the topic (see Two Simple Relative Strength Rotation Models).

Since I had a little time this Christmas-Eve afternoon and was feeling motivated by BZB Trader’s excellent post from this morning (now included, see “BZB” below) to get started on this particular New Year’s resolution, I fired up Google Docs and here is the result.The embedded table below will be updated dynamically each day, so you may check in on current ranks regularly should you so desire.

Dynamic Weekly Ranks

The mechanical system assumes equity is reinvested once a week (Friday afternoons — though given the length of holds, I imagine the following Monday should be just fine) in the highest ranked security according to a simple relative strength formula (see orange colored cell). I was somewhat limited by how far I could go with this in Google Docs, so I settled on a simple stop-less model evaluating six select ETFs representing major asset classes featuring varying degrees of inherent risk, as follows:

- SPY – Large Capitalization U.S. Equities

- IWM – Broad Capitalization U.S. Equities

- EEM – Emerging Market Equities

- AGG – Aggregate Bond Index

- DBC – Commodity Basket Index

- UUP – US Dollar Index

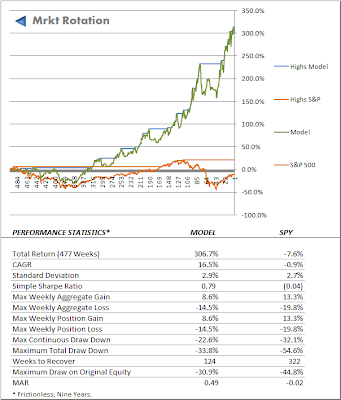

Historical Performance

While this is hardly a complete system as presented, you can see that the simple switching model is nonetheless quite tradable and performed admirably during one of the most difficult decades for investors in recent memory. Do note that many of the ETFs only more recently became available, however. In the earliest years it was a contest between IWM and SPY alone.

Nevertheless, with a little money management, I’d imagine one could go quite far with a little system like this, particularly in a 401-K type account. At the very least, it is a terrific way to read the current risk appetite of the markets. I will revisit and improve on the model throughout 2010.

Never Investment Advice