We are going to return to our ‘decade theme’ today as we search for perspective with regard to the current markets situation.

The ‘decade theme’ is based on the idea that the markets have been moving through similar trends over the past few decades. Cyclical asset price peaks in the ‘0’ year (commodities in 1980, Japan in 1990, the Nasdaq in 2000) followed by grinding corrections into the ‘2’ year. Trend corrections in the ‘4’ year leading into peaks and subsequent crashes and crises during the ‘7’ and ‘8’ years (1987 stock market crash, 1997- 98 Asian crisis, 2007- 08 subprime debacle). The ‘9’ year includes a speculative recovery that builds into a cyclical asset price peak. Rinse and repeat.

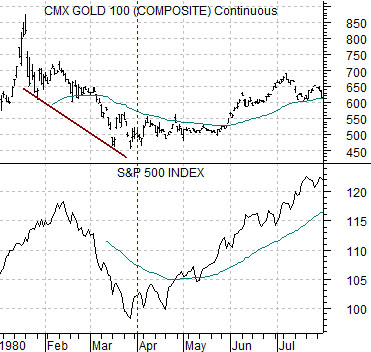

Below we compare gold futures and the S&P 500 Index through the first seven months of 1980. Gold represents the asset class that rose to a cyclical peak into the ‘0’.

Next we have included a comparison between Japan’s Nikkei 225 Index and the SPX through the first seven months of 1990. In this example the Nikkei represents the asset class responsible for making the cyclical top into the ‘0’ year.

We are comparing gold in 1980 and the Nikkei during 1990 with the S&P 500 Index for one simple reason- the U.S. stock market was clearly not the sector reaching a speculative peak. For this very reason we are not showing a comparison from 2000 because in that instance certain sectors within the U.S. stock market were clearly part of the problem.

In any event… our first point is that in both 1980 and 1990 the asset class making a cyclical peak corrected right through the first quarter. In other words if history were to repeat the pressures working on the markets at present could run through the end of next month.

The second point would be that it is not completely clear what market is making a cyclical peak. Our thought is that isn’t a market or sector per se but rather a theme. A theme, strangely enough, defined through U.S. dollar weakness. Put another way it isn’t China, Hong Kong, or copper prices that have made a peak or even the Brazilian real and commodity stocks. Instead it is the broad theme that money has pushed towards as an offset to U.S. dollar weakness. From this point of view the market that would correct through the first quarter wouldn’t be gold and the Nikkei to the down side as much as it could be the dollar to the upside.

NEW YORK/LONDON, Feb 4 (Reuters) – Copper prices plunged to their lowest levels in more than three months on Thursday, as growing concerns over the euro zone’s fiscal health and tighter monetary policy in top consumer China drove investors away into the safety of the U.S. dollar.

We are going to try to tie our first page point into a topic that we have been sitting on for a week or two as we attempted to find the right time and place to introduce it. Actually it is an argument that we have made on many occasions in the past although it presents a somewhat different perspective at the current time.

The idea is that over the past number of years… long-term Treasury yields (we use 10-year yields on the chart below) have trended higher over the first six months of the year and then lower over the second six months. In other words… the markets have favored a strong cyclical trend (the kind that goes with rising yields) over the front half of the year and a more defensive theme over the back half.

Now… this year could be different. Yields could tumble through June which would only mean that the dominant theme is defensive in nature. However… the tendency of late has been for yields to rise quite strongly from March through June so we will give the markets the benefit of the doubt for the time being.

Below is a chart comparison between the U.S. Dollar Index (DXY) futures and the ratio between the Philadelphia Semiconductor Index (SOX) and copper futures.

The chart makes a fairly straightforward point. When the dollar is weaker copper prices are far stronger than the chip stocks. When the dollar is stronger then the semiconductors blow the doors off of base metals prices.

One of the reasons the equity markets are so weak these days is that the dollar is rising and copper prices are falling but… the sector that is supposed to outperform is falling just a fast. In other words it isn’t copper prices that are the problem but rather the lack of strength in the tech sector. The SOX/copper ratio should be stronger so as long as the markets keep hammering the tech stocks each time they raise guidance one will have to expect more trading days like yesterday.