One of the problems associated with arguing in favor of one economically sensitive sector while making negative comments on another is that, by and large, cyclical is cyclical. If we argue, for example, that copper prices are ‘too high’ and will collapse back towards last year’s lows while at the same time making the argument that the semiconductor stocks appear poised for additional gains… we need to sit back, take a deep breath, and remind ourselves that cyclical is indeed cyclical.

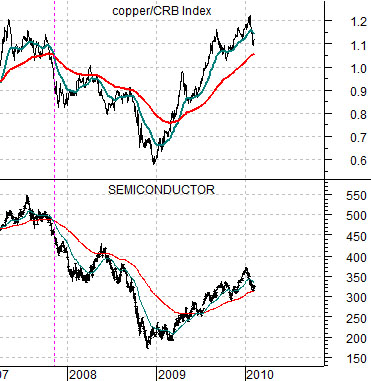

To explain… we have included two chart comparisons at right. Both show the ratio of copper futures to the CRB Index (i.e. copper relative to general commodity prices) and the Philadelphia Semiconductor Index (SOX). The first chart is from 1994 through 1997 while the second chart covers the time period between early 2007 and the present day.

We grant that there is a major difference between copper prices and the ratio between copper prices and the CRB Index because the ratio can rise even if copper prices are flat to lower as long as the trend for general commodity prices is even weaker.

Aside from that the chart at top right makes a relatively simple point. When the trend for copper prices is strong enough to push the copper/CRB Index ratio upwards… the trend for the semiconductor stocks tends to also be positive. When the copper/CRB ratio weakens to the point where the 50-day e.m.a. line crosses down through the 200-day e.m.a. line- an event that took place in the autumn of 1995 and again in the summer of 1997- one should probably have already exited positions in chip stocks.

In terms of the current situation we can see that the moving average lines for the copper/CRB ratio crossed in late 2007 around the time that the Chinese stock market began to decline but months ahead of the mid-2008 top for energy prices. The ratio bottomed at the end of 2008 and was positive through all of 2009. We will argue that the semiconductor stocks can rise quite powerfully in between the first peak for the copper/CRB ratio (i.e. in late 1994 and early 1997) and the subsequent crossing of the moving average lines. All of which means that an ideal set up for the chip stocks this year would include a ‘flat’ trend for the ratio at or near current levels. The longer the ratio holds well above 1:1 (copper closed around 298 today versus 266 for the CRB Index) the better the intermarket back drop for the SOX.

We are going to continue on today with the copper/CRB Index ratio.

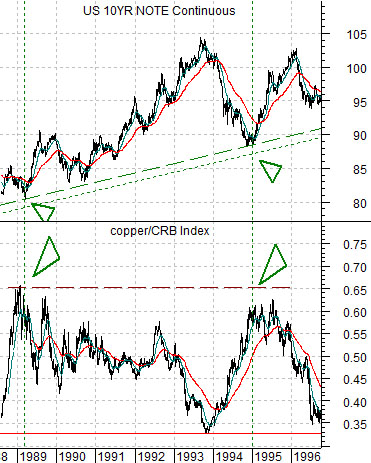

At right is a comparison between this ratio and the U.S. 10-year T-Note futures from 1988 through 1996.

The argument is that a strong copper/CRB ratio tends to go with weaker bond prices. This actually makes sense (to us) because rising copper prices typically go with falling bond prices.

The two peaks for the copper/CRB ratio in 1999 and 1995 went with trend line ‘bottoms’ for the T-Note futures.

Below right we show the same comparison for the current time frame. Notice that when the copper/CRB ratio reached a peak in 2006 and then again in 2007 the T-Note futures had fallen to lows associated with the same rising trend line that served as support in both 1989 and 1995.

The point? We are perfectly capable of changing our minds almost daily with regard to the bond market but in terms of this perspective we could see the copper/CRB ratio holding at or close to current levels through the first six months of the year as the 10-year T-Note futures slowly work back down towards the 109- 110 level. This would equate to yields close to 4.5%.

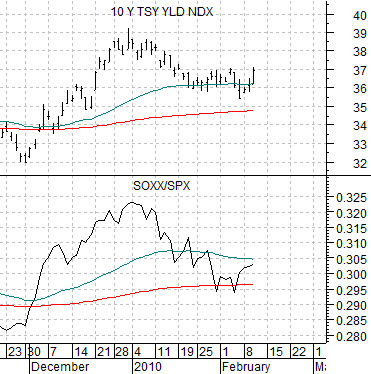

Below is a comparison between the yield index for 10-year U.S. Treasuries (TNX) and the ratio between the SOX and the S&P 500 Index.

If copper prices remain ‘flat’ relative to the CRB Index then what cause 10-year yields to rise from just under 3.7% today up to 4.5%?

The argument is that yields tend to trend quite closely with the ratio of the semiconductor stocks to the broad market. When the Nasdaq/SPX ratio or the SOX/SPX ratio is rising we tend to get an upwards tilt for yields.