Although the major indices chalked-up a bounce last week, volume was tepid and the up/down profile as measured in RSI momentum struggled to make meaningful gains toward the “50-yard line.”

The Nasdaq edged out SPX with the better bounce, as its price relative strength (vs. SPX) impressively closed near its high marked this past December. In fact, the Nasdaq had shown the lowest reading of stocks trading above their 50-day moving average, matching the level last seen in March 2009, and was (still is) ripe for short-term outperformance. The index (and most others) sit precariously between their 50 and 200-day moving averages, seeking short-term support at pullback levels marked during the climb from July through December.

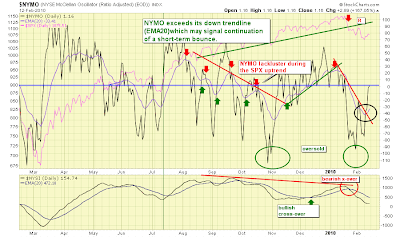

VIX settled down (its RSI nudging slightly below 50) and Put/Call has moves to neutral territory. Similar to RSI performance noted above, the NY McClellan Oscillator surged from deeply negative levels without an impressive equity rally; its surge in late Oct/early Nov was met with a much more impressive, forceful stock market rally (click on the chart below).

The continued relative weakness in financials, and the renewed outperformance in staples vs. discretionaries (see below), flash caution.

The continued relative weakness in financials, and the renewed outperformance in staples vs. discretionaries (see below), flash caution.

Baseline Analytics remains neutral-bearish (with appropriate stops).