Friday closed the day red across the broader markets, the week closed the NDX, COMPX, SPX green and the Dow red. Volume fell off on Friday, going into a three day weekend that was to be expected even though it was the last day of the month. The TRIN closed at 2.38 very bearish and the VIX at 32.07 about 10% under the 10dma. Gold closed the day down 20 cents to $1211.70 and oil down 63 cents to $73.92 a barrel.

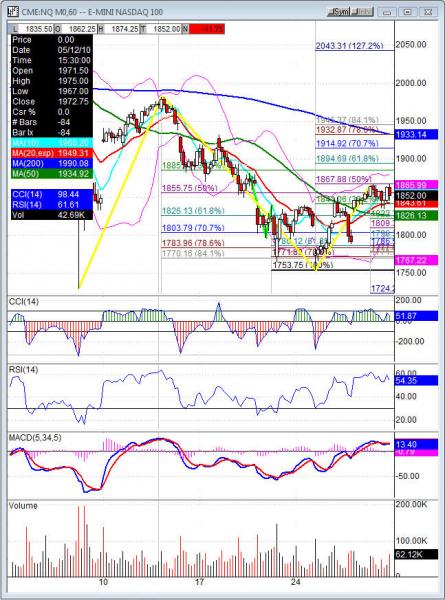

The Nas Composite, S&P 500, and the Dow had inside down days on Friday. The Nas 100 traded through Thursday’s highs, but closed within Thursday’s range and red. The indexes still have a gap open overhead from May 19th and one open from May 26th below Friday’s close. Both will provide magnets for the market and also look to for support/resistance. The daily charts on the broader indexes have the CCI just under 0 line resistance, MACD the lines are together and tilted up, stochastics are crossed up, RSI is pointed up on each. That opens the door for the upside, but not without some drag on the move. The SPX and Dow both sit just under the 200dma, while the NDX and COMPX sit over the 200dma.

The final hour sold the market off and that was more nervousness about holding through a three day weekend. The market doesn’t know what can happen so looks for profits in the unknown. Uncertainty makes the market nervous and not knowing if another Greece, Portugal or Spain could happen is unnerving. Also the South Korea incident wasn’t far from investors mind and just getting through May was enough for the week. Moving into Tuesday we can look for a higher move on the markets IF there aren’t any incidents over the weekend. NDX 1872.30, COMPX 2291.32, SPX 1109.17, Dow 10341.20 resistance should be watched for on any strength. The weekly pivot is under Friday’s close and will be a rotational point on futures. Shortened weeks tend to move in spurts and take a little effort to get moving on Tuesday morning. So be patient and look for some upside early Tuesday.

Economic data for the week (underlined means more likely to be a mkt mover): Tuesday 10:00 ISM Manufacturing PMI, 10:00 Construction Spending, 10:00 ISM Manufacturing Prices. Wednesday 7:30 Challenger Job Cuts, 10:00 Pending Home Sales, All day Vehicle Sales. Thursday 8:15 ADP Non Farm Employment Change, 8:30 Unemployment Claims, 8:30 Revised Nonfarm, Productivity, 8:30 Revised Unit Labor Costs, 10:00 ISM Non Manufacturing PMI, 10:00 Factory Orders, 10:30 Natural Gas Storage, 11:00 Crude Oil Inventories, 11:15 Fed Chairman Bernanke Speaks, 12:15 FOMC Member Rosengren Speaks, 1:15 FOMC Member Hoenig Speaks. Friday 8:30 Non Farm Employment Change, 8:30 Unemployment Rate, 8:30 Average Hourly Earnings.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market nothing due out and after the bell PSS, SNDA. Wednesday pre market DAKT, MDCI, ROLL, UNFI and after the bell APSG, CWTR, HOV, JOSB. Thursday pre market JOYG, STP, UTIW and after the bell COO, DCP, MATK, TTWO, ULTA. Friday pre market BTH, MPR and after the bell nothing due out.

NQ (Nas 100 e-mini) Tuesday’s pivot 1851.25, weekly pivot 1826.50. Support: 1847.50, 1842.50, 1835.75, 1826.50, 1822.25, 1817.50, 1809.25, 1796.25, 1786.50. Resistance: 1855, 1859, 1862.50, 1867.75-1868.25 fills gap, 1873.75, 1881.50, 1894.75