Morning Watch List: TTM BIIB TRW CSIQ CLR LDK POT KBH MDRX SLM STP

Not by best day and things turned into just trying to break even and preserve my green streak instead of following my rules.

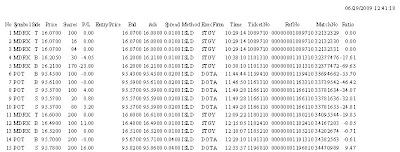

| Stock | Shares | Gross | Side | Fee | Net | Set-Up | Yes |

| POT | 200 X 2 | 24 | Flip | -7.32 | 16.68 | None | n/a |

| MDRX | 200 X 2 | -8.85 | S | -7.54 | -16.39 | Top Fade | no |

| $0.29 |

MDRX – Shorted a break out, giving it a wide stop; where I shorted around $16 it was actually a nice pullback (for a long entry) to ORH before it steadily rose to over $16.60. Later, I successfully faded it for a dime drop to reduce my losses on this tick.

POT – First I longed a half position. It spiked twenty cents; I meant to close out but added another 100 shares long, thus eating away on the profits on the first trade. The second play I got a bad fill – so likely $20 in slippage here between both transactions. This stock I wasn’t using my opening range strategy and just trying to play the top or bottom of the range on a fast moving day ranger.

Recently, I have NOT been paying for my lack of discipline but I know it will catch up to me soon. My life balance stuff is all of whack too, and I know that’s were structure and consistency starts with my behavior. Before I was being sloppy with my exits but today it slipped to my entries as well.

The safest and most reliable sets are to Opening Range High Breakouts, by longing them when they pullback to ORH, or Opening Range Low Breakdowns, shorting on a bottom bounce back to ORL. Here are two charts on stocks in which I had orders open today but did not pull the trigger:

The green lines on the charts show the 15-minute opening range high and low at 9:45am.

Opening Range High Breakout (ORH-BO)

Opening Range Low Breakdown (ORL-BD)

Bottom Bounce (Bot-Bou)

Top Fade (Top-Fade)