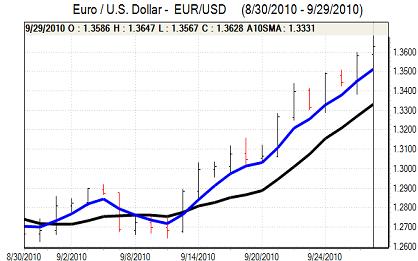

EUR/USD

Market conditions were slightly calmer on Wednesday, but there was still an underlying lack of confidence in the US dollar and it remained under pressure during the day.

There were no fresh US economic data releases with markets still unsettled by weakness in consumer confidence seen the previous day. There was further speculation that the Federal Reserve would adopt further quantitative easing at the November FOMC meeting despite some reluctance to adjust policy in the run-up to congressional elections. Regional Fed President Rosengren, who is an FOMC voting member this year, stated that further quantitative easing would depend on forthcoming economic data.

The Euro-zone business confidence index was slightly stronger than expected which provided some degree of Euro support. There was also relief that demand was lower than expected in the latest ECB tender operation which helped ease immediate fears over liquidity stresses.

There were still important fears surrounding the financial sector with a further downgrading of Allied Irish bond credit ratings. In this environment, the Euro remained dependent on dollar weakness to make headway. There was no improvement in US confidence and the Euro pushed to a fresh five-month high near 1.3640 before consolidating.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Domestically, the headline Tankan business confidence index improved to 8 from 1 the previous month which was marginally stronger than expected. The rate of improvement has, however, slowed and companies were less confident over the fourth-quarter outlook which dampened confidence.

There was further speculation that the Bank of Japan would decide on further quantitative easing at next week’s policy meeting. Risk conditions were initially slightly firmer on Wednesday which dampened immediate demand for the yen with an improvement in China’s PMI index. The dollar was still trapped below the 84 level as underlying demand remained weak.

There were media reports that the Bank of Japan was looking at ways to weaken the yen through policies other than intervention. The yen weakened briefly following the reports, but the dollar was unable to sustain the advance and retreated back towards 83.50 later in the US session as yield support remained lacking.

Sterling

Volatility levels were lower during Wednesday with Sterling still unsettled by comments on the need for further quantitative easing from MPC member Posen the previous day.

The UK economic data was generally subdued with money-supply growth remaining weak while there was also a decline in consumer credit for the month. Total consumer lending was stronger than expected with a reported gain from mortgage lending, although this figure was a surprise given the reported weakness in mortgage approvals.

There was further speculation that the Bank of England could consider further quantitative easing at next week’s policy meeting and there were also strong expectations of a three-way split within the committee with uncertainty curbing demand for the currency.

Sterling was also held back by a more hesitant attitude towards risk and Sterling weakened to a four-month low beyond 0.8640 against the Euro. The UK currency consolidated just below 1.58 against the dollar with widespread US weakness still cushioning Sterling from further selling pressure.

Swiss franc

The Euro found support below 1.3250 against the franc on Wednesday and pushed to highs near 1.3350 before consolidating just above 1.33. The US dollar found support below 0.9750 against the franc, but was unable to sustain a move above 0.98.

There was a period of franc weakness in European trading as safe-haven demand dipped, but the currency was able to resist heavy selling pressure.

The KOF business confidence index was almost static at 2.21 for September and this does suggest that momentum is slowing, although the index remains at an historically very level which will limit any immediate damage to the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

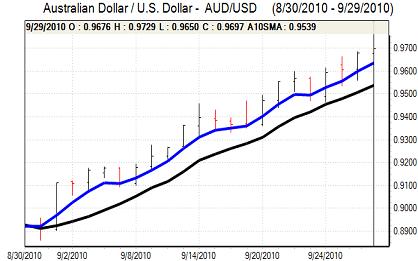

Australian dollar

The Australian dollar has maintained a firm tone over the past 24 hours, primarily as a continuing function of US currency weakness and it pushed to a fresh 2-year high close to 0.9730 against the dollar.

The domestic data was weaker than expected with a decline in housing sales for the third consecutive month and there are important risks surrounding the domestic economy. International considerations remained important and a slightly more cautious attitude towards risk pushed the Australian currency back to below the 0.97 level with retreats still generating buying support.