EUR/USD

The Euro remained under pressure during Monday with negative developments surrounding technical and fundamental factors and the currency retreated to 10-week lows below 1.31 against the dollar.

There was a persistent lack of confidence in the Euro-zone economies with a continuing focus on the contagion threat. Following the EUR85bn rescue package for Ireland, there was further speculation that other countries would also require support and officials were unable to restore confidence. In this context, the main focus was on Spain and Portugal with Italy also considered vulnerable. There were also fears that the European support fund created earlier this year would not be large enough to managed any required bailout for Spain.

The credit default swaps for Portugal and Spain both widened to record levels during the day and there will be further speculation over the eventual break-up of the Euro. Even if the contagion threat can be contained, there will be additional pressure on the ECB to maintain a highly-expansionary monetary policy and it will certainly be much more difficult for the central bank to withdraw special liquidity arrangements and this will curb Euro support.

Technically, the Euro also weakened to below the 200-day moving average and over the past two years this has been an important indicator of medium-term direction.

There were again no major US developments during the day with attention focussed firmly on the Euro, but the there will be important data releases over the next few days which will be important for underlying dollar sentiment. The dollar will be in better shape to secure wider gains if there is evidence of improving growth conditions. The Euro consolidated close to 1.31 in Asian trading on Tuesday as underlying sentiment remained negative.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a firm tone against the yen during Tuesday with some support on yield grounds, but was unable to move beyond the 84.50 area as the yen gained significant support.

The Japanese currency will continue to gain net protection from the lack of Euro-zone confidence and the general decrease in international risk appetite will also provide important yen protection.

The domestic data provided no yen support with industrial production weakening for the fifth successive month while there was a small increase in unemployment and the PMI index remained below the 50 level.

There was further speculation over a Chinese interest rate increase during Monday and this contributed to the deterioration in risk conditions which also provided support for the yen with the dollar drifting back towards 84.0

Sterling

Sterling was again influenced strongly by the Euro-zone developments during Monday and advanced to fresh 2-month highs against the Euro during the day. There was further selling pressure against the dollar, but there was some buying support below 1.5550.

There was a slight increase in consumer credit according to the latest data, but underlying borrowing is still likely to be subdued given unease over general economic conditions and there will be expectations of a further deterioration early in 2011.

The latest independent economic forecasts did not make major changes to the budget deficit forecast which will provide some relief. Given the underlying government borrowing profile and private-sector debt levels, there is still the risk of a sudden deterioration in confidence surrounding the UK economy and currency.

For now, Sterling remains generally insulated from market attention and it consolidated just below 1.5550 against the dollar in early Asia on Tuesday.

Swiss franc

The franc secured renewed defensive support against the Euro during Monday with the Euro retreating to 2-month lows below 1.32 with a break of support triggering fresh selling pressure to a trough below 1.31. Given franc strength on the crosses, the dollar was unable to make further progress against the franc and consolidated close to the 1.00 level.

The Euro-zone trends will inevitably be extremely important in the near term and the Swiss currency will gain important protection from fears over the Euro’s future. There remains the possibility of sustained capital flight into Swiss assets which would certainly cause alarm within the National Bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

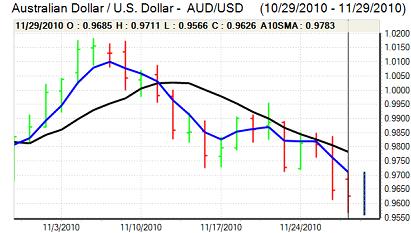

Australian dollar

The Australian dollar maintained a defensive tone during Monday as international risk conditions remained unfavourable.

Fears over a Chinese interest rate increase will remain an important negative factor for the Australian dollar, especially with renewed doubts as to whether a controlled landing would be possible. The Australian currency was unable to rebound strongly from the 0.9580 support zone.

There were further concerns over the threat of a slowdown in the domestic economy which also had a negative effect, although the latest economic data was actually better than expected as building permits rose strongly.