“The U. S. dollar is recapturing its role as the primary safe-haven currency, eclipsing the yen and the Swiss franc, as tensions in Korea and Europe escalate.

That re-emergence as the ultimate sanctuary for those fleeing risk will likely result in continued strength against major rivals in the next few weeks, analysts expect.

‘Recent events just reinforce the underlying message that during times of turmoil, almost no matter what the source, the U. S. dollar is seen as a safe harbor for investors,’ said Doug Porter, an economist at BMO Capital Markets in Toronto.” (http://professional.wsj.com/article/SB10001424052748704008704575639022158300444.html?mod=ITP_moneyandinvesting_1&mg=reno-wsj)

The question is “how long will the U. S. dollar remain a safe haven?

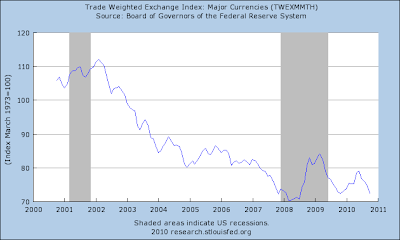

Twice in the past three years, the United States dollar has served as a “safe haven” for the world. Once, following the financial collapse in the fall of 2008, the value of the United States dollar against the currencies of major currencies rose from a trough in March 2008 of 70.3 to a peak of 84.0 in March 2009.

The next trough came in November 2009 at 72.2, but the sovereign debt crisis in the Euro-Zone in early 2010 caused the value of the dollar to rise again as a “safe haven”, peaking at 79.0 in June of that year.

After June the dollar, once again, continued to decline, falling to 71.0 in the first full week of November 2010. As mentioned above, the value of the United States dollar is now climbing.

Most analysts, including myself, believe that the long term trend in the value of the dollar is down. The United States government is basically un-disciplined with little or no self-control. This is not a slam against the Democratic Party because I believe that the Republicans have acted in a similar way. Fiscal deficits have led to mountains of federal debt, and the example set by the federal government has been emulated by the public at large over the past fifty years building up more-and-more debt over time. The Federal Reserve has supported this credit inflation and has even underwritten a large portion of it…and promises to underwrite a whole lot more.

The consequence of this lack of discipline and self-control has been reflected in the decline in the value of the dollar over the past forty years, since President Nixon floated the dollar. The chart below just shows us what has happened over the past ten years where the primary culprit has been the Republican Party.

From the peak value reached in February 2002 the dollar reached a trough in March 2008, 37.3 percent below the earlier peak. The dollar became a “safe haven” in the fall of 2008 and moved from its March trough to a short-term peak in March 2009, rising by 19.4 percent. Once this move was over, the value of the dollar dropped once again, this time by 15.5 percent.

The point is, the long-term pressure on the value of the United States dollar is to decline. This can be observed very clearly in the accompanying chart.

Since the value of the dollar was floated and the current data series began, January 1973, the dollar has declined by about 34.4 percent. So, the general trend of the value of the dollar since it was set free has been downward. Over the longer haul, nothing has really changed much in the way of American economic policy.

The bottom line to all of this is that nothing has changed in the past fifty years as far as the fundamental philosophy behind the economic policy of the federal government. The long run prospect for the value of the dollar is down!

There will be upswings, flights to the “safe haven”, but the basic trend will be downwards.

But note, the 2008 recovery in value of the dollar went on for about one year before the decline set in again. Therecovery in value associated with the euro-zone sovereign debt crisis lasted only seven months before the movement down began once more. The short-term peak reached in 2010 was 6.0 below the previous peak in 2009.

But note, the 2008 recovery in value of the dollar went on for about one year before the decline set in again. Therecovery in value associated with the euro-zone sovereign debt crisis lasted only seven months before the movement down began once more. The short-term peak reached in 2010 was 6.0 below the previous peak in 2009.

How long will this move into the dollar “safe haven” last and how high will the value of the dollar reach?

My guess is that the value of the dollar will move upwards for several months. The peak will be somewhere in the neighborhood of the March 2009 peak and the June 2010 peak. But, the decline will begin once again.

And, the longer run? As the periphial countries in the euro-zone get their acts together and become stronger over time, attention will look for other countries that need to be chastized. After Greece, Ireland, Portugal, Spain, Italy, and possibly France…will the focus of the financial markets turn to the Unitred States…and not as a “safe haven”?