What a Difference a Month Can Make

As we stand today, the major indices have turned positive for the month of June. This is quite a difference from the dismal performance of the indices in May. In May, all anyone could talk about is the Euro, the European debt crisis, and the Chinese tapping the brakes on their high-speed economy. All the other “problems” creating headwinds for the market seemed to fade way. Consider this excerpt from the Wall Street Journal (WSJ) today …

NEW YORK—U.S. stocks gained, as ebbing fears over a contraction in global growth brought back appetite for riskier assets. Strong euro-zone data and encouraging comments from a member of the U.S. Federal Reserve encouraged modest optimism, sending global stock markets climbing. “It looks to me like stocks are passing the fear phase here over Europe and China,” said Jerry Harris, president of asset management at Sterne Agee. “China does not need to mount a big campaign to re-accelerate their economy. All they’ve got to do is take their foot off the brake and I strongly suspect they’re in the process of doing that.” St. Louis Fed President James Bullard, speaking in Tokyo, said Monday that he expects an Asian-led world economic recovery to continue, and that he didn’t see evidence of a Chinese bubble. Nor did he think the European debt crisis was poised to derail the economic recovery.

Does this mean a sustained rally is in motion? Does it mean the rush to the “safe heavens” of gold and U.S. Treasuries is over? At least for the moment, money seems to be flowing back into commodities and equities, as the quote below from the same WSJ article points out.

Demand for safe-haven assets slackened. Treasurys (sic) slipped, pushing the yield on the 10-note up to 3.31%. Gold futures also declined, while crude-oil prices rose above $75 a barrel.

Hold the horses. Maybe this is not as strong a turn as is needed. Consider this in the context of the recent turn to the upside – volume has been light. When volume is light, one has to consider the possibility that uncertainty still reigns. Perhaps, the positive upward move on light volume simply means less people are selling, rather than more people are buying. When this situation occurs, bad news flowing out (no pun intended regarding the disaster in the Gulf) can turn the positive into the negative in a flash. And as everyone understands, in these strife-ridden times, bad news is sure to pop up again any day, which brings us back to the other “problems” not talked about recently. We all know what those are, so no need to go over them here. Suffice it to say either or both geo-political issues and U.S. domestic fiscal/economic issues have the potential to derail U.S. domestic economic recovery, and, by extension, any sustained rally in the markets.

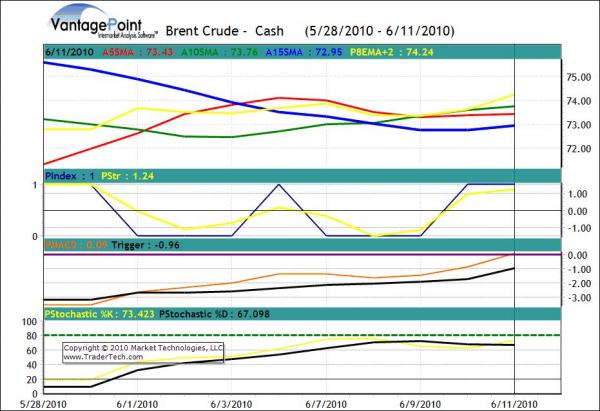

So what looks to be the “trade of the day” now? Certainly, in the short term, oil looks to be a strong trade, and, perhaps, in the longer term as well if the global economic recovery holds on and gets stronger. In the VantagePoint chart below, note that all indicators, including the Predicted 8-Day EMA +2, point to upward price movement for Brent Crude.

Source: VantagePoint Intermarket Analysis Software

To see more FREE recent market predictions for 70+ Futures markets go here!

A turn to the upside based on the positive beliefs about both Europe and China is good, no doubt, but it looks as if volatility will continue for some time, as the overhang of back-burner big issues still lurks. In the meantime, though, as long as those issues remain on the back-burner, the market, even with light volume, might well push higher on the front-burner, which presents short term opportunities both in equities and commodities. Given the fragility of the current global economic recovery – and in particular in light of near zero short term interest rates on safe-haven Treasury bills, for baby boomers, retirees and others looking to goose-up their passive income with some degree of controlled risk, this will have to do for now.

In the longer run, though, given the ‘new normal’ expectations of lower economic growth, increased market volatility, and continued deleveraging at all levels, traders (and ‘investors’) will need to become much more nimble at getting into and out of a wider range of asset class vehicles than ever before, including agricultural and soft commodities, ETFs, metals and currencies – and not limit themselves to individual U.S. equities. This type of environment will, of course, require that traders utilize the most sophisticated trading analytic tools that they can get their hands on, and steer clear of outdated methods of technical analysis that have not kept up with the unprecedented speed of change that has reshaped the global economy and the financial markets.

Best Wishes,

Lou Mendelsohn