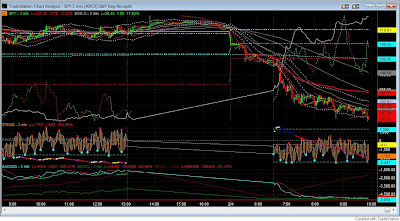

Ouch! Overseas action was a big heads up, but I didn’t day-trade the easy opening action and am pinching myself for that. Otherwise I am happily sitting mostly in cash. This has allowed me to put a little bit of capital to work here, but note that I’m 100% hedged for now. Internals are fairly awful and this looks like a down trend day, so this is crucial until we see intraday signs of a turn around. Just now the bowl shaped floor is giving out and volume is the highest we’ve seen in nearly two weeks.

One concern is that this will open the door for shorts to try their luck for once and push price all the way down to the 200-day ema, which increasingly seems within grasp near SPY $104.75 (see early thesis on this from last week). Even stronger support is technically indicated between there and the 200-day sma, which corresponds roughly with the early November lows (say between $102 and $103). Look at that VIX go, +18% — Yee-Ha!