Internals are strongly supportive today with upside alignment among all the non-price indicators that I track. Interestingly, the VIX is also higher, but it may just be resetting from the Friday/weekend decay phenom. It has been a long, long time since we have seen such an extended directional run. More on this later today (see ‘Runs update’ below). I’m sure I sound like a “perma-bear” here, but whichever side of the trade you are on, I’d suggest it would be healthy for some small pullback sooner rather than later.

Internals are strongly supportive today with upside alignment among all the non-price indicators that I track. Interestingly, the VIX is also higher, but it may just be resetting from the Friday/weekend decay phenom. It has been a long, long time since we have seen such an extended directional run. More on this later today (see ‘Runs update’ below). I’m sure I sound like a “perma-bear” here, but whichever side of the trade you are on, I’d suggest it would be healthy for some small pullback sooner rather than later.

Runs update – as of Friday, the QQQQ’s had strung together eight higher closes. Over the last ten years, I see two other times that occurred, both in 2005 (May and November). While both marked a very short-term swing high, eventually they went on to post further gains. Of course another high today would therefore be unprecedented in recent history. Sorry, not much to go on there.

Quick Chart Study:

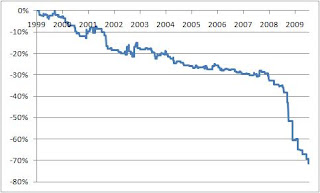

Go long the SPY at the close and hold for one day when both the SPY and VIX close higher. Ten-year period, frictionless, simple returns:

(Ok, so you want to see the other side too right? The answer is much less/ more volatile edge.)

(Ok, so you want to see the other side too right? The answer is much less/ more volatile edge.)