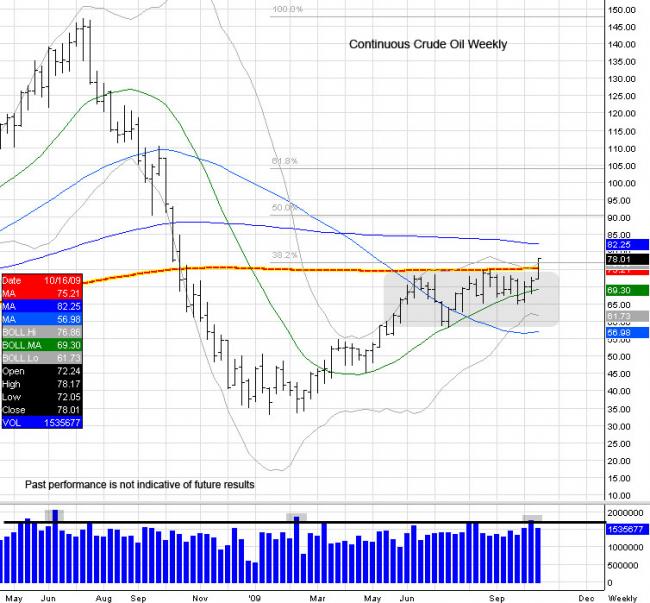

Continuous Month Light Sweet Crude Oil Weekly:

The coiled up consolidation mode in oil has sprung and in the favor of the bulls. The nine month trend higher from the lows has now exceeded the seven straight months from the record highs to the lows, a movement in which started in February with oil at 35. Prices doubled by June before reaching a wall at the 200 day moving average. Prices have been consolidating for five months as the fight between bulls and bears emerged. Currently, the market is breaking out of its five month highs, and attempting to continue its upward trend by trading through the 200 day moving average. The strength and momentum should give the bulls drive to reach for and test the upper 80s. This breakout is also fueled by shorts who are being squeezed out as they are looking for the market to fail and move lower. Bulls continue to look for the 85-90 target. Off of the lows, this also retraces oil 50% to the highs. Major support is at $65-$60.

Continuous Light Sweet Crude Oil Monthly:

Black gold has shined 133% off of the lows from February of 2009. Taking the perspective from a big picture standpoint, this move is a 38% retracement to the highs of last year. What will be important here is how strong these levels will hold and if the market can continue at this pace. The market is trading within strong resistance between $75 and $80, with next major resistance and bull target of $90.

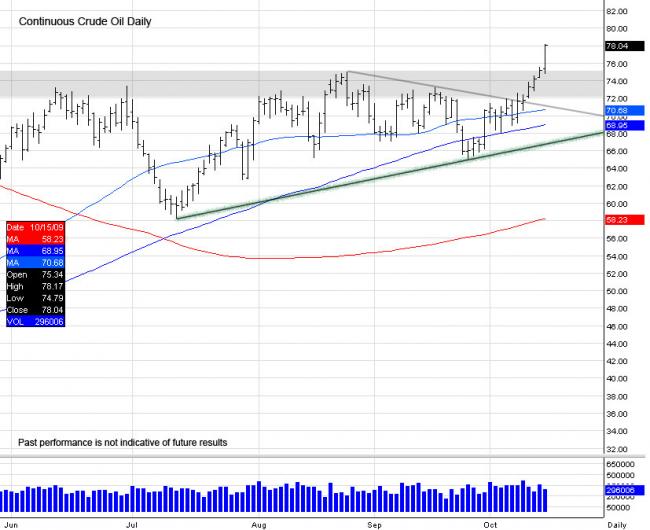

Continuous Light Sweet Crude Oil Daily:

A failed head and shoulders formation in oil with a failed breakdown late September leads oil to breakout to new highs for the year.

The lows of $58 in July and the highs of $75 in August spewed a $17 range. As the market has broken out the pennant recently at $72 and through the ‘head’ of the h/s formation August through September, strength can add $17 to the breakout of $72 giving a reference and target of $89 for this new momentum.

Continuous Natural Gas Monthly:

Natural gas has tested the trend line from the 1999 lows and even traded under by a little over 50 cents, washing the market out as natural gas worked on finding a bottom. This was not done previously and many were trying to pick this bottom. Sure enough, the bottom has taken it’s time to form, eroding the nerves of longs. After making a new low down to $2.409 in September, natural gas reversed and started the squeeze higher. This has created an engulfment on the monthly chart for September (seen above) and closing above resistance of $4.50. Support should be found down to $3.90 which is near 50% of the move in September from the opening to the close.

Continuous Natural Gas Weekly:

Natural gas tried breaking out early May only to find that the market was unable to move past $4.50, which repelled confirmation buyers looking for signs of strength in hope for a turn around. Natural gas has flagged lower for four months to make new lows, which then reversed off of those lows and created a “false breakdown” (highlighted in red). This false breakdown and reversal squeezed prices back to the upper part of the range. As the November natural gas, however, became the front month, it created a $1 gap higher on the continuous chart (from $3.98 to $4.94). In my opinion, this opening higher above $4.50 can now attract confirmation buyers that were standing on the sidelines. This can be seen as a sign that the market is turning around. What market bulls will want to see is for the gap to act as support and look for weaknesses as opportunities to position in the market. Patience will continue to be the key in my opinion. This is made possible as close to $4.00 if given the chance. Using the green shaded area for entry, and a move under $3.00 as a reference for exiting if the market gets back to those levels. A target of near $6.00 is reasonable for bulls, as this marks a 50% retracement from $9.60 to $2.40. This may also be where the 100 and 200 day moving average meet with prices.

I have previously been cautious about the markets attempt to bottom out. In my perspective, however, I now believe natural gas is ready to move higher. I would be more comfortable establishing long positions and letting the market work if it fails to rally and makes new lows than exit trade.

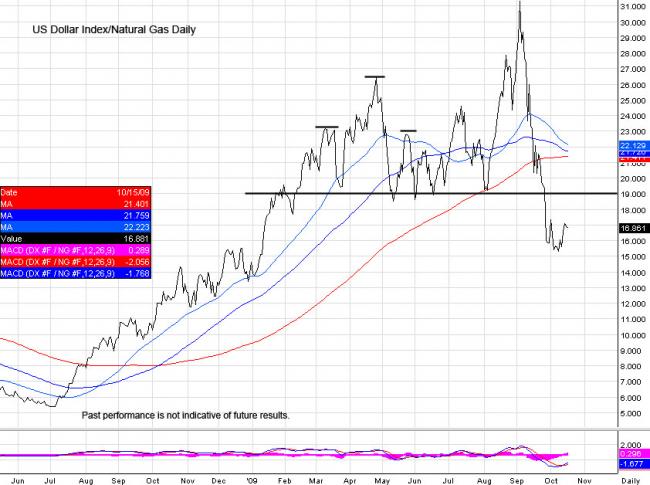

Continuous US Dollar Index/Natural Gas Daily:

Remember the head and shoulders formation between March and May with the relationship of Natural gas into the US Dollar Index? This topping formation that would potentially bring natural gas strength failed to materialize early and 19 proved to be strong support. After natural gas made a new low and washed out, this ratio climbed above 30. Now it is back down and through support of 19. This number should now act as resistance and we shall see if the trend continues lower as natural gas strengthens against the US Dollar Index. See ’06/08/09 Energy Market – Crude Oil & Natural Gas Update’ for reference.

Continuous US Dollar Index Weekly:

Receive emails and alerts ahead of time, visit Stewart Solaka @ Lasalle Futures Group

Thank you and best of luck trading!

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.

Comments and questions to the author, please write or call 888-325-9300.

Follow www.twitter.com/chicagostock