We’ve begun to notice an anomaly within the interest rate futures where the volatility of the 10-Year Treasury Note is significantly higher than both shorter and longer dated maturities. Rather than attempting to answer why this may be, we’d rather focus on the trading opportunity it presents both within the interest rate sector and as an outright speculative trade.

First, let’s look at some data. The current trade setup involves the pricing distortion between the 10-year Treasury Note and its current point in the yield curve between the 5-year Treasury Note and 30-year Treasury Bonds. The yield on the 10-year Treasury Note climbed from 2.19% on June 1st up to 2.43% by July 1st. That’s an 11% jump in yield. Meanwhile, the 30-year Bond’s interest rate climbed from 2.94% to 3.2%, a climb of only 4.3%. The 10-Year Note has come back a bit to mid-level, now at 2.28%. However, Friday’s parallel rally in price across the interest rate sector did push the 10-Year Notes into the beginning of the resistance area I’ll use to create a short position.

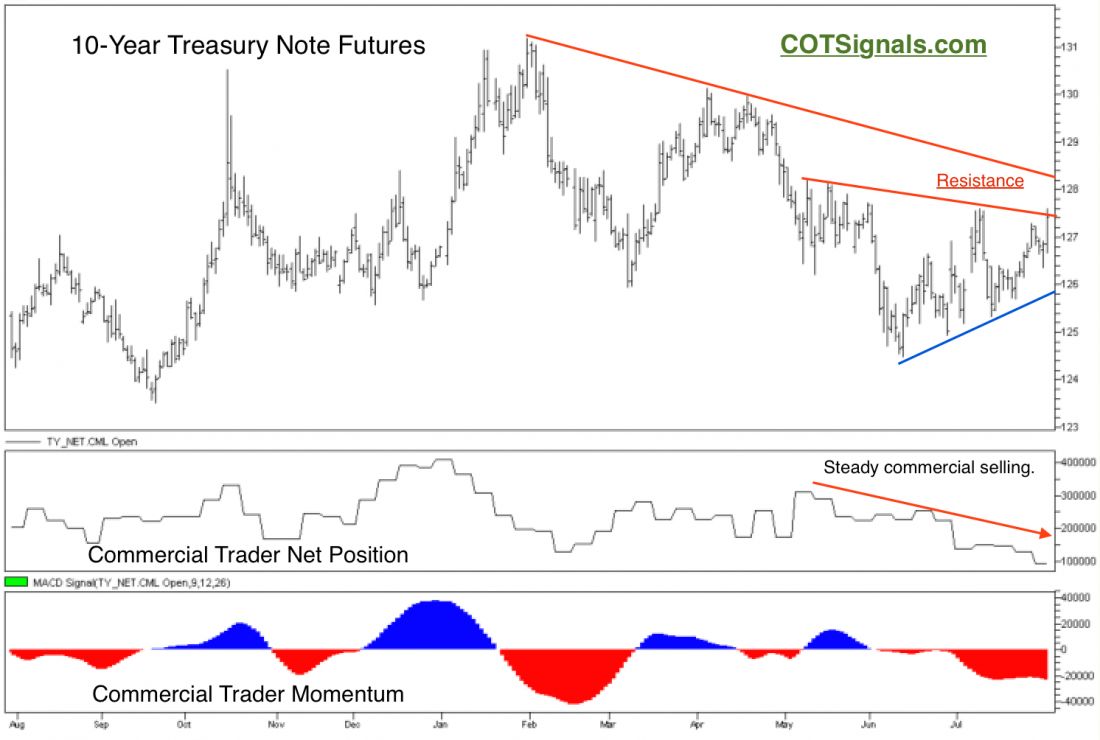

Looking at the chart above, you can see Friday’s action pierced the near-term resistance trend line dating back to May. You can also see that commercial traders were once again net sellers this week to the tune of 36,000 contracts. This makes their position the most bearish it’s been since May of 2013. Therefore, we don’t believe the recent rally in the 10-Year Treasury Note futures is likely to hold.

Our entry technique on fading breakouts is typically to wait for some type of reversal. One never knows quite how high or, low a market can go. Waiting for the reversal accomplishes two main tasks. First, it provides an indication that the market is in fact ready to move in our anticipated direction. Secondly, it provides us with a chart point to place our protective stop loss order. We ALWAYS trade with active protective stop orders against all of our positions.

Finally, the real success of this trade will be the test of the upward sloping trend line now near, 126 as the market heads into Friday’s unemployment report.