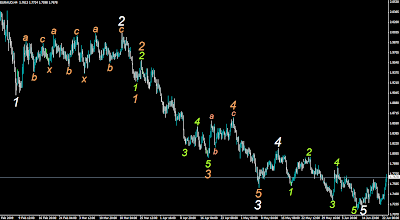

I think I don´t have much anything new to bring with these charts, but all are updated again.

They are as clear for me as they can meaning reversals – good money flow. Nothing new to mention. At some stage later need to start looking what waves we actually track with them.

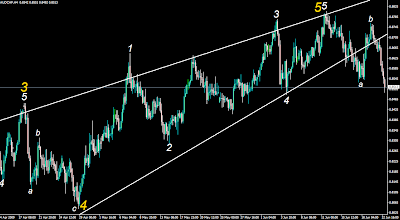

Eurodollar looks interesting in here also, actually it just hit triangle bottom and I bought it 1,3838, but no clue does it going to carry, leaving it overnight anyway with line stop. Rather stick & swing with those diagonal chart positions as they “rock and rolls” day after day.

Pretty easy day. Eurodollar hit my top roof estimated last week with just 5 pips error, but I think it happend in very late friday session, since then it´s been dropping down as it should – but still it´s relative dead flat lazy compared for Yen, Aud and Cad crosses. In fact it offered just a very few good subminuette trade setups today which is very unusual for eurodollar, mostly it offers many rounds during the day. In last friday it didn´t offer any at all which would be clear enough to take. I smell than something upside is clearly missing in here with it. It behaviour from last 3 sessions indicates different ew degrees for different direction and that´s the reason why it´s so dead flat. However, it´s main direction is down for me to the 1,3400 – 1,3000 area.

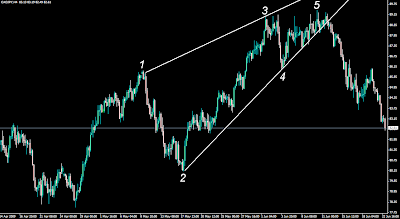

Oil top price is propably seen & over from this summer now and should be under more meaningfull correction mode which should keep any commodity currency under pressure.

Somehow I´ve found this market in recent weeks relative easy to follow and have time to do plenty of other things also without monitoring all the time. Perhaps UsdJpy is the one which is too complex for my taste to breake it for waves. Why bother ? Stick with easy setups only. I might enter for wondering “EW equites” for a while if nothing more dramatic challenge in this department will not raise hands any time soon.