10,500 – that’s 75% of 14,000 in the Dow!

10,500 – that’s 75% of 14,000 in the Dow!

On the S&P we topped out all the way up at 1,550 in October, 2007 so 1,162 would be the target there. For the Nasdaq it’s 2,100 (already over), 7,750 on the NYSE is still far away and 637 on the Russell is tantalizingly close (5%ish). The SOX still need to gain 30% to get back to 400 and the the Transports are going to need a lot of gas to get back to 2,250. (see Fallond’s breakout charts here)

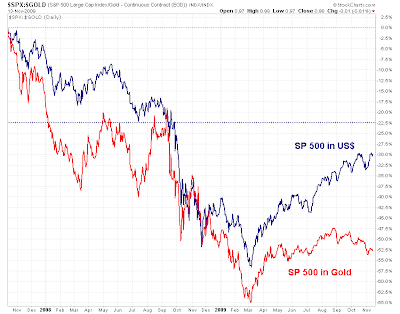

Oil was $100 a barrel in October 2007 so $75 is right on track and gold is clearly our over-achiever, UP 42% from 2 years ago and that is “obviously” according to the pundits, because the dollar is trading 1.5% lower than it was back then. We are being led higher by great companies like XOM who, at $75 are well above their 75% level at $67. This is VERY impressive since they earned $9.4Bn in Q3 ‘07 and just $4.7Bn last Q on 20% less sales but that doesn’t stop investors (or at least tradebots) from snapping them up at these prices.

TRV was added to the Dow and that stock is now OVER the 2007 highs of $52.50, which is really impressive as they are doing it with less revenues ($200M) and less earnings ($263M, 21%). Perhaps we are seeing a pattern? Earn 50% less, like XOM and get valued 16% lower, earn 21% less, like TRV and get valued 5% HIGHER. CAT was at $70 in Q3, 2007 with $11.4Bn in sales and a $927M profit so OF COURSE they are at $60 now (down just 14%) on $7.3Bn in sales and $404M in profits. Just like XOM, 56% less earnings equals a 14% haircut on the stock price. After all, you can’t fool these savvy investors, can you?

TRV was added to the Dow and that stock is now OVER the 2007 highs of $52.50, which is really impressive as they are doing it with less revenues ($200M) and less earnings ($263M, 21%). Perhaps we are seeing a pattern? Earn 50% less, like XOM and get valued 16% lower, earn 21% less, like TRV and get valued 5% HIGHER. CAT was at $70 in Q3, 2007 with $11.4Bn in sales and a $927M profit so OF COURSE they are at $60 now (down just 14%) on $7.3Bn in sales and $404M in profits. Just like XOM, 56% less earnings equals a 14% haircut on the stock price. After all, you can’t fool these savvy investors, can you?

I’ll be going through the Dow in detail this weekend as we set up our new Buy List for Members as (if we are going to accept the premise that these investors are not crazy) there are certainly some bargains in the Dow like VZ (got ‘em already), who earned $1.3Bn on $23.8Bn in sales 2 years ago and earned $1.2Bn on $27.3Bn in sales last Q, yet they are still trading 25% below where they were. INTC made more money on less sales but they are trading 20% off while DIS made more money on more…