Gonna try to a new system for titling my posts…

Watchlist: HBC SNE SPR SNE FLS HIG WYNN IP XRAY PLCE AKAM EXPE

Market Structure: BULLISH-OPEN. At one point, I had 7 breakouts and only 1 breakdown. Watchlist was twice as many gap ups. Big move happened between 9:45am and 10:00am and mostly traded in a range after that, through FLS broke-out mid-morning and WYNN had a dramatic top fade. My strategy was to long ORH-BOs on pullbacks, but there wasn’t a continuation of the original opening move and so far, there are many top fade set-ups.

| Tick | Shares | Side | Gross | Fee | Net | Set-Up | Actual |

| SNE | 200 | L | 65 | -2.8 | $62.2 | Bot Bou | ORH-BO |

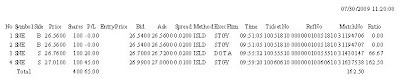

One trade more a result of the chop after 10am than hesi-trading. SNE was a nice safe stock with a tight opening range after gapping up. It pulled back to ORL, which was near $26.50 – when it bounced above that price threshold and the rest of the watchlist was in synch with a rally – I entered long. I didn’t get a fill at my original price, but didn’t give up and got in at $26.56. I took partial profit at $26.76 just a couple minutes later, and then exited the rest at $27.01 This was my price target but there was no sign of the stock slowing down at this stage and my exit was based on emotions.

Going forward, I’m going to change my exit rules slightly. Right now I have been taking partial profit after only a .20 cents move, and then move the rest to break-even. From now on, if a stock is within .25 cents of a whole number price theshold, instead of taking profit at a twenty cent move, I will move my stop loss order to break even on the trade, and instead move my partial profit target to the whole price number. So on this one I would of taken profit of 100 shares at $27.01 for $45, and then would of been stopped out for the rest at around $26.98 for another $42 for a total potential profit of $85 net. However, if the stock reaches my full profit target of $27.50, this would be a $140 winner. With stocks with higher day ranges (this one was around .70), these targets will be stretched.

I need to increase the average size of my winning trades. By taking profit a little later, this will help. The result will be less $20 winning trades and more break-even or small losers for stocks that make an initial move in my favor but fail to continue.