Subscribers to Seattle Technical Advisors.com know of a seven-year cycle in commodities which is due to bottom near year-end. With cycles this big we can’t be accurate to the day, week, or even month but having entered the last third of the year I thought it might be a good time to look at how commodities are playing out so far this year.

In my March 10, 2014 column “Copper plunges on China Concerns”, with copper at 3.15, I wrote that I had downside price target of 2.96. The very next week I found myself writing again about copper (“Has Copper found a bottom?”) as it had come within 0.03 of my target. It rallied from there (notwithstanding the big drop in June) and has been pulling back since mid-July. The price action this year looks like a symmetrical triangle which is a continuation pattern – a continuation of the downtrend that started at the commodity cycle top 2011. Depending on where the lower trend line is breached we can expect to see copper go as low as 2.65 before a final low.

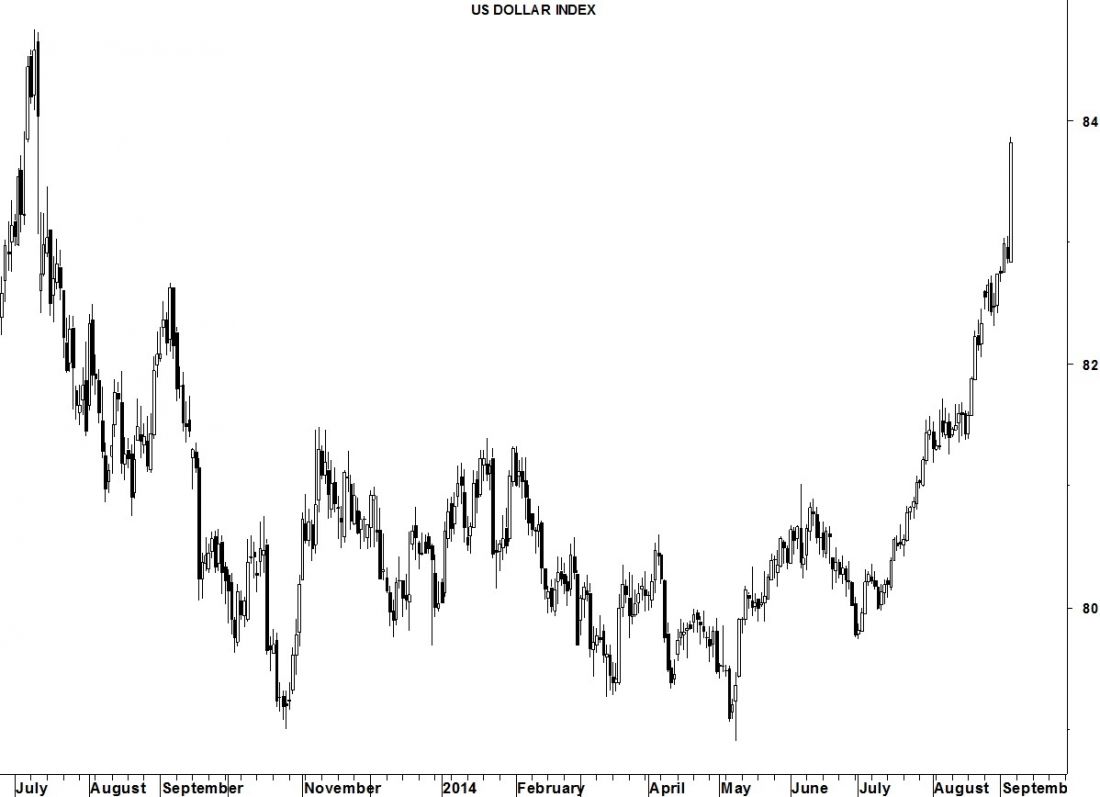

In my August 4, 2014 column “Big Picture Outlook: Commodity Currencies” I included a chart of the Canadian dollar and pointed to a broken bear flag pattern and how that should mark the end of its bear market rally which had been helping to prevent commodities from go into a free-fall. Since then declines in crude oil and gold have accelerated, presumably, into the expected low near year-end. Of course, with the world’s commodities priced in US dollars, an opinion on the dollar is needed to confirm any long-term view on commodities. In my June 30 column “Cycle work points to a low for US dollar this summer” I showed a 3year cycle in the dollar which typically lasts about 3years and 3months. I also wrote that we might have seen the cycle low early (May) this year. The bottom was in May but the 13-month cycle in June that I mentioned marked a higher low. Since then, the dollar has been soaring, driving commodities toward the seven-year cycle low mentioned above. If commodities are not going to touch bottom until year-end, the dollar should have more gains ahead.

As for gold, while my price target was too low we did see the seasonal bottom in June mentioned in my 6/2/14 column “Inflation expectations lead to gold bottoms”. In that article I explained that inflation expectations had me wondering if the bottom would come relatively early (the low was on June 3). With the break of important support at 1,270 gold needs to regain that level (quickly) or plan on more losses between now and year-end.

= = =

Get your copy of the August Lindsay Report at SeattleTA.