UPDATE: USB did bounce today from the bottom low. I probably should of had my stop under $15 which would of exposed to me only a $20 loss. I got stopped out by a nickel.

Watchlist: SVNT BCS ACH RJF PAAS HBC GMCR FRO SLT UBS

Market Structure: CHOPPY-OPEN (Bullish Bias) ~ I had trouble figuring out how the day was playing out. I had significantly more gapping up stocks (8 out 10 on my watchlist). However, things opened with weakness, with 3 stocks breaking down. At 10am, there was a sharp reversal on my watchlist and at one point 8 of the stocks were breaking out of their 15 minute ORH. Most of the stocks bounced off their bottom lows, and that bounce was the best move of the day so far.

Today, I did a good job of eliminating distractions and focusing on my trading, but did not see a clear set up. I decided to take a half position to get some skin in the game.

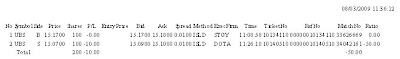

| Tick | # | Side | Gross | Fee | Net | Set-Up | Actual |

| UBS | 100 | Short | -10 | -1.37 | -$11.37 | Bot-Bou | Mixed |

My rationale on UBS was it was sitting at the bottom of its morning low after falling from its high. I was trading long in the direction of the gap up, fading a fall at the bottom of the range. However, this was late morning, and the bullish momo had stalled overall so there was no bounce. More importantly, ORL was around $15.15, and it’s logical that UBS would go down to $15 to test a whole-number threshold and still stay for the most part to stay range-bound.

I got the first trade of the week and month in so I should be ready to come out swinging tomorrow.