It’s starting!

The last of the bears are now capitulating. We’re hearing it in Member Chat and we’re reading it in analyst reports and we’re seeing the fund managers on TV – it is very out vogue to be a bear.

Just a few weeks ago, I pointed out to Members how few bears remained by saying “Look to your left, look to your right, look in front of you and look behind you – you would be the only bear.” That was way back when “only” 20% of investors were bearish – as of yesterday, we lost 1/3 of those poor creatures and now only 13% of the market is bearish. Now you can look diagonally as well and you’ll STILL be the only bear!

Just a few weeks ago, I pointed out to Members how few bears remained by saying “Look to your left, look to your right, look in front of you and look behind you – you would be the only bear.” That was way back when “only” 20% of investors were bearish – as of yesterday, we lost 1/3 of those poor creatures and now only 13% of the market is bearish. Now you can look diagonally as well and you’ll STILL be the only bear!

Certainly the market seems to be proving the primary axiom of “You can’t fight the Fed.” Pretty much no matter what happens, the market goes up. Bryan Leighton from Traddr! Makes a good point saying: “It’s a neutral to positive market and the only thing that can change that is some sort of surprise event out of Europe or out of Asia or something major out of the US that the Fed is not ready for or prepared for. If they are prepared for it – it will not happen – it will not have a major effect on the markets.”

That’s the reality we’re dealing with out there. As long as the Fed and their pet IBanks are running the markets and as long as volume is at 3-year lows, allowing the TradeBots to control each move – then it is wrong to be a bear. But, is it 87% wrong? 87% bullish sentiment isn’t just “very” bullish – it’s a new, historic high. It’s like going to a fight where the entire crowd only cheers for one guy which, like professional wrestling, would be an automatic indication that the game must be fake, Fake, FAKE!

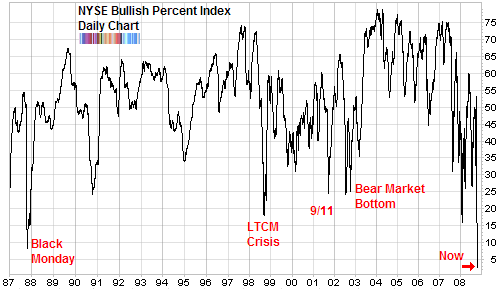

As you can see from this longer-term chart, we are as extremely bullish now as we were extremely bearish in the two worst market events of the past quarter-century. Much the way that Black Monday of 1987 and the Crashes of 2008/9 were unique buying opportunities at 15% bullish, this may be a unique shorting opportunity at 15% bearish that you are not likely to see again for…

As you can see from this longer-term chart, we are as extremely bullish now as we were extremely bearish in the two worst market events of the past quarter-century. Much the way that Black Monday of 1987 and the Crashes of 2008/9 were unique buying opportunities at 15% bullish, this may be a unique shorting opportunity at 15% bearish that you are not likely to see again for…