Guest post courtesy of Jordana Balsam of Elitetradingtip’s Blog

The New Year is finally here and so are the resolutions. That time of year when we tell ourselves this is the year we will get in shape, excel in our careers, volunteer, find a soulmate, or ‘fill in blank’. All are good goals to strive to achieve and if the start of calendar year is what provokes the incentive to take action then so be it.

The New Year is finally here and so are the resolutions. That time of year when we tell ourselves this is the year we will get in shape, excel in our careers, volunteer, find a soulmate, or ‘fill in blank’. All are good goals to strive to achieve and if the start of calendar year is what provokes the incentive to take action then so be it.

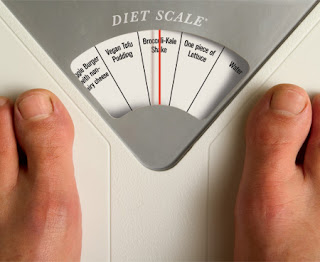

In trading there is no room for New Year’s resolutions. Everyday should be considered THE day to take action and RESOLVE. In trading, as in all industries, you should be constantly updating and reviewing, analyzing what’s working and what is not. Daily, weekly, and monthly reviews of how to approach the market and what to change in your trades. There is no room for procrastination. The mentality of “the diet starts tomorrow” is not an option.

New Year’s resolutions are not about willpower and restriction, but rather, they are about STRUCTURE. The mentality of a dieter should not be “What am I NOT going to eat today?”, but instead, “What AM I going to eat today?” The mentality of a trader needs to be “What charts am I going to review today?” and “What trades am I going to put on today?”

A wise man named Al once said: “You get one life. There are no dress rehearsals.”

I try to adhere to that philosophy. I try not to let opportunities slip away and it helps keep my thoughts in perspective to allow for the little things to roll off and not stress about them. It reminds me that we get one chance in life and this is it. His point was: it’s now or never.

Another wise man said: “Look, if you had one shot, or one opportunity to seize everything you ever wanted, one moment, would you capture it or just let it slip? You only get one shot, do not miss your chance to blow, this opportunity comes once in a lifetime.” Eminem. Genius. Ask yourself what you plan to do about your life today and how you can enhance it NOW, not because it’s your New Year’s resolution but because it’s the next opportunity to improve your year.

The best method for taking control and making everyday a resolution to improve is to keep a journal of your trading. Do it the old fashioned way, with a pen and paper. Be specific and tactical about market moves–-keep track of everything from the daily, the weekly and monthly trends.

It’s important to keep track of what is working now as well as refer back to what was working days, weeks, months and even years ago. Trading works in cycles so by keeping track, it will help you understand current market conditions. For those traders who traded in the 1970s, this current market may seem very familiar.

The MOST important routine, which can be applied to ANYTHING in life is to monitor the voices inside your head. Your own psychological state can deter you from or escalate you to achieving your goals. Journal about your own psychology and mental state of what went into the process during those trades. By documenting your state of mind, you can read back on your thoughts and judgements. You will be more apt to keep yourself as objective as possible and sort out the emotions that influence your decision making ability. Again, this procedure is applicable to ALL things in life.

A good way to measure how you’re doing is to read back on your journal entries from last year and years prior, also when times were tough and trading was bad. Read about the goals you had set for yourself and the methods you applied to achieve them. This will help you regain your confidence.

Just as important is to keep yourself in check and not allow yourself to get arrogant and lazy when you do have success. Read back the entries when your confidence was low and remind yourself that the market doesn’t remember how great you are today. Continue to stay at the top of your game and apply that same energy it took to realize success.

Happy New Year!!!

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs.