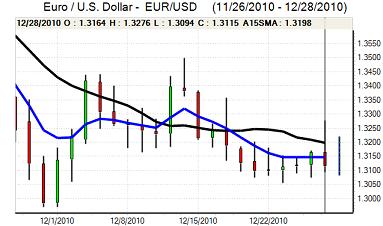

EUR/USD

The Euro fluctuated around the 1.31 level against the dollar during the Christmas period in very thin trading conditions before volatility increased sharply on Tuesday.

The Euro advanced strongly to a high above 1.3275 against the US currency with stop-loss buying and a covering of positions. The Euro was unable to sustain the gains and fell sharply during the US session with a low below the 1.31 level. As has been the case over the past few sessions, the Euro found support near the 200-day moving average with short-term players still reluctant to hold short Euro positions below 1.31.

The US economic data was generally weaker than expected with consumer confidence declining to 52.5 for December from 54.3 the previous month, in contrast to expectations of a modest gain. The latest Case-Shiller house-price index was also weaker than expected with an annual decline for the first time during 2010, although the Richmond manufacturing survey was strong.

There will be further unease over the US housing sector and this is likely to dampen yield support for the US dollar, especially as housing doubts will make the Fed even more reluctant to remove aggressive monetary easing.

With most markets closed, the Euro has secured some respite from underlying fears and funding issues. Underlying confidence is still extremely weak and there will be further speculation over major funding difficulties during the first quarter of 2011.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above 83.50 against the yen during the Christmas period and dipped sharply to a six-week low near 81.80 on Tuesday before regaining the 82 level.

The dollar was unable to gain fresh yield support, especially with disappointing economic data which dampened interest in the US currency. Risk appetite also dipped immediately following the Chinese interest rate increase which boosted demand for the Japanese currency, especially with year-end capital repatriation still an important feature.

Domestically, there was a recovery in industrial output for November which will provide some relief. Nevertheless, there will still be strong pressure on the Finance Ministry and Bank of Japan to curb yen appreciation. In comments on Tuesday, Finance Minister Noda stated that the market moves were being watched closely and that there would be bold action if necessary. The dollar consolidated above 82 in Asia on Wednesday with volatility an important risk over the next 2 days.

Sterling

Sterling briefly advanced against the dollar on Tuesday with a high close to 1.55, but it was unable to sustain the gains and weakened rapidly back to test support near 1.5350. The UK currency has also had a generally negative tone on the crosses with lows near 0.86 against the Euro before a recovery.

There have been further negative reports surrounding the UK housing sector and there will be expectations of very fragile conditions during 2011. There have also been some reports of weaker than expected retail spending, although individual data will be erratic.

Overall confidence in the economy is likely to weaken and this will remain a negative Sterling factor with persistent doubts whether the Bank of England will be in a position to increase interest rates.

The banking sector will remain an important focus and Sterling will be extremely vulnerable if there are fresh bad-loan provisions during the first few weeks of 2011. The UK currency was able to hold above 1.5350 against the dollar on Wednesday as the US currency retreated from its best levels.

Swiss franc

The dollar was unable to sustain a move above 0.9650 against the franc and dipped sharply to record lows below 0.9450 on Tuesday. Although the US currency was generally vulnerable, the move was intensified by persistent franc strength on the crosses as it rebounded from temporary weakness at the end of last week.

There were reports of corporate demand for the Swiss currency and there was also persistent demand in the face of very weak Euro-zone confidence.

National Bank President Hildebrand stated that the strong franc was a burden, but markets were doubtful whether further intervention would be sanctioned, especially as the latest UBS consumption index held firm. The dollar managed to regain the 0.95 level late in the US session on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

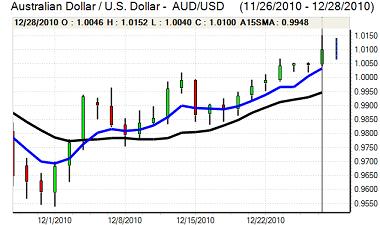

Australian dollar

The Australian dollar retreated following the Chinese interest rate increase during the weekend and briefly tested support below parity before regaining support. There were fresh 1-month highs gains to above 1.01 against the US dollar on Tuesday as commodity prices remained strong.

There has been evidence of corporate Australian dollar selling and there are important reservations over the currency’s valuation at current levels. For now, the currency is continuing to gain support from a lack of attractive alternatives.