What ProAct Traders sees in the Forex starting the week of Dec 5th, 2010 – http://wp.me/piiLm-OA

$EURUSD

WHAT ProAct Traders SEE: The market has broken to the upside and looking for a continuation to the .500 fib initially at 1.3440. We should see some consolidation here before the run to the .618 fib. A break of the .500 fib targets the R6 @ 1.3579. A move down to the R5 (1.3346) first is not out of the question. Breaking back inside the trend line would target the 1.3209 area. With USA jobless rates (NFP) showing no signs of improvement and the possibility of NOT keeping the Bush tax cuts for the middle class ,even though Europe has their own problems, dollar should remain under pressure.

——————————————————————————–

$USDJPY

WHAT ProAct Traders SEE: NFP caused a strong reaction on the cross but they should square up this move before resumption to the downside. S4 @ 82.03 shows a good interim target on the way to the 81.73 strong support. Upside risk is a triple top @ 84.42.

——————————————————————————–

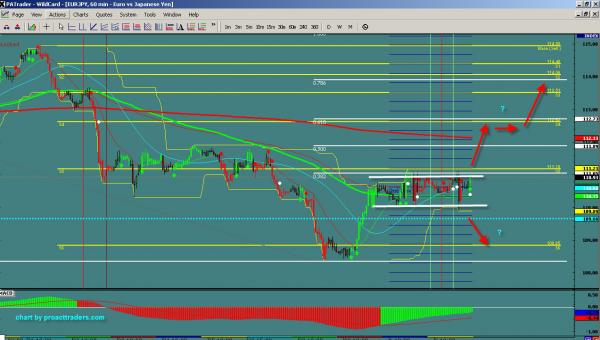

$EURJPY

WHAT ProAct Traders SEE: We are nearing a critical consolidation zone. Cross is showing signs of a move up with a rectangle forming on the 60 min right at the .382 fib. This is bullish for the cross but we are still in a bearish trend. Still a little early to tell whether it will favor the upside or down. Targets up would be the .786 fibe at 114.00 and downside looking for a move back to the R6 at 108.85.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

WHAT ProAct Traders SEE: We have broken the trend line to the upside. Should stall at the .618 fib at 9947 for a run to the R6 at 1.0153 and back to parity. Currently this is an unsustainable trend so wait for a pullback and buy on the dips.

——————————————————————————–

EXTREME CAUTION IS URGED – TRADE WITH STOPS!!!!!

IMPORTANT NOTICE: These comments are for information purposes only. The information contained on this document does not constitute a solicitation to buy or sell by ProAct Traders, LLC., www.proacttraders.com and/or its affiliates, and is not to be available to individuals in a jurisdiction where such availability would be contrary to local regulation or law. Opinions, market data, and recommendations are subject to change at any time. Forex trading involves substantial risk of loss and is not suitable for all investors. We monitor multiple indicators as well as established chart analysis.

There is No “Holy Grail” in trading systems. Do not use our research or any other trading system without proper research on the asset.

This is an opinion ONLY – and not a trade call, but a study that may lead you to a trade. I do not know whether this will transpire or not so use your own judgment.