EUR/USD

The Euro initially consolidated above 1.30 against the dollar on Wednesday and then pushed higher during the European session.

The ECB was an important focus of attention and Thursday’s meeting will also be extremely important for Euro sentiment. In comments on Wednesday, ECB Chairman Trichet suggested that the ECB might provide additional support for the Euro. There was strong market speculation that the bank would announce a major bond-buying programme on Thursday. There were also expectations that the bank would announce that extraordinary liquidity measures will not be removed in the short term.

There was also speculation that there would be additional funds for the European support fund, possibly with an increase in IMF funding. There was a tightening of peripheral yield spreads during the day which helped underpin the Euro and it advanced to a high around 1.3180.

The Euro will be vulnerable to renewed selling pressure if the ECB disappoints market expectations and any expansion of bond buying by the central bank would also compromise longer-term expectations of a hard currency.

The US ISM manufacturing index was close to expectations with a figure of 56.6 for November from 56.9 previously. The latest ADP employment report was also firmer than expected with a private-sector employment increase of 93,000 for November from a revised 82,000 in October. There will still be caution ahead of Friday’s payroll report, but there will tend to be a slightly more positive assessment of US conditions which will help underpin the dollar.

The Euro retreated back to the 1.31 area in Asia on Tuesday as markets waited for the ECB announcements.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 83.50 against the yen during Wednesday and advanced to a high around 84.30 during the US session.

The US currency gained support from higher Treasury yields following the batch of favourable economic data and an easing of risk aversion also curbed defensive demand for the Japanese currency.

The Korean situation will be watched closely and will continue to have a mixed yen impact. Fears over any escalation in tensions will ten to undermine the yen, but the Japanese currency would gain support from any general increase in risk aversion. The net implications are liable to be slightly negative for the yen.

The dollar still retreated from its best levels with markets still very cautious over the Euro-zone contagion risk. Any further increase in Libor rates would also tend to boost defensive demand for the yen.

Sterling

Sterling initially found support on dips towards 1.5550 on Wednesday and strengthened following the UK data. The latest CIPS manufacturing-sector report was stronger than expected with a rise to a 16-year high of 58 according to the latest survey which boosted optimism in the manufacturing sector.

Sterling was unable to sustain initial gains and retreated to re-test support near 1.5550. There was some reversal in capital outflows from the Euro which dampened immediate demand for Sterling and there were also fears that the dominant services sector would face much tougher conditions which will limit currency support.

Trends in global risk appetite will also be monitored closely and Sterling will be vulnerable if there are sustained tensions within the banking sector. The UK currency consolidated around 1.56 in Asia on Thursday with the Euro finding resistance above 0.84.

Swiss franc

The Euro found support near 1.30 on Wednesday and advanced strongly to a high near 1.32 following expectations of increased ECB support for the Euro. Given franc weakness on the crosses, the dollar was able to push towards 8-week highs above 1.0050.

Trends within the Euro-zone will tend to remain dominant in the short term and any disappointment with the ECB actions on Thursday would tend to trigger fresh gains for the Swiss currency.

The banking sector will also be an important focus and the franc could still be vulnerable if confidence in the Swiss financial sector starts to weaken again. The dollar was able to maintain a position above parity in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

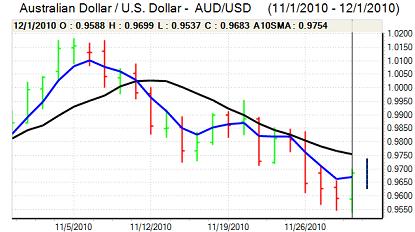

Australian dollar

The Australian dollar found support near 0.9550 against the US dollar on Wednesday and pushed to a high of 0.9680 as risk appetite improved.

The retail sales data was much weaker than expected with a sharp 1.1% decline for October and there will be further doubts surrounding the domestic economy which will tend to sap Australian dollar support and it edged lower to the 0.9625 area before finding support.

International conditions will also remain important and the currency will be vulnerable to renewed selling pressure if risk conditions deteriorate again.