EUR/USD

The Euro was unable to move above the 1.3610 region against the dollar on Tuesday and was then subjected to renewed selling pressure which culminated in a 2-month low around 1.3360 before a corrective rally from over-sold conditions. As well as its internal vulnerabilities, the Euro was also undermined by a wider deterioration in risk appetite.

There were further important stresses surrounding the Euro-zone during day which maintained the negative market tone. There was a serious lack of confidence surrounding the Irish situation with fears that political considerations could sabotage a rescue deal. Standard & Poor’s also downgraded Ireland’s credit rating by two notches while there was also a widening of spreads between German and Spanish bonds to a record high as markets fretted over the underlying contagion risk.

The German Finance Minister commented over how serious the situation was and Chancellor Merkel stated that the Euro was in an exceptionally serious situation. Other officials looked to play down the remarks, but the rhetoric certainly undermined confidence and triggered further selling, more than offsetting the impact of firm Euro-zone PMI data.

The US economic data was slightly weaker than expected with a dip in existing home sales to an annual rate of 4.43mn from 4.49mn, although the impact was limited. Minutes from November’s FOMC meeting revealed that the Fed also held a conference in mid October to discuss quantitative easing. A plan was proposed to target a rate of the long-term US Treasury bond yield and buy unlimited Treasuries if required to secure this target.

From the dollar’s perspective, there will be relief that this plan was rejected in favour of the US$600bn package as yield targeting could have put the dollar under severe pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar spiked higher to above 83.80 on Tuesday following news of an exchange of artillery fire between North and South Korea, but the dollar support was measured and it quickly retreated to the 83.25 area.

Although Korea was a background factor which undermined the yen, the Japanese currency also gained defensive support from a general increase in international financial risk aversion as the Euro-zone difficulties persisted.

The dollar was hampered by a dip in yields and tested support near 82.80 before regaining the 83 level late in the US session. The dollar held steady in Asia on Wednesday as the Japanese currency gained support on the crosses.

Sterling

Sterling was unable to make a break above resistance in the 1.5950 area against the dollar on Tuesday and was then subjected to renewed selling pressure with a dip to 4-week lows below 1.5780 before a partial correction. Wider Euro losses were again the dominant theme as Sterling was also able to reach a 2-month high against the Euro.

Risk conditions will be watched closely and the UK currency will be vulnerable to selling pressure if there is a sustained deterioration in risk appetite. There will also be further underlying fears over the underlying domestic debt profile as any substantial decline in asset prices would trigger renewed fears over the UK banking sector.

The latest mortgage approvals data was weak with a decline to the lowest level since March 2009 which will maintain fears over the housing sector.

Swiss franc

The franc continued to gain support on the crosses over the past 24 hours with the Euro retreating to lows near 1.33 against the Swiss currency. The dollar was able to make a small net advance, but was trapped below parity despite a strong advance against the Euro.

The Euro-zone contagion risk will remain a very important market feature in the short term and there will tend to be further defensive support for the franc. There is also still the possibility of more substantial capital flight away from Euro-zone assets.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

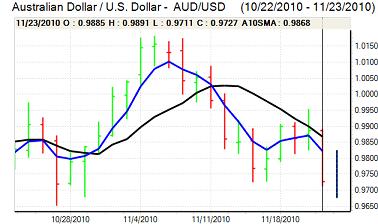

Australian dollar

The Australian dollar continued to hit resistance above 0.9850 against the US dollar on Tuesday and was exposed to periodic bouts of heavy selling as risk appetite deteriorated.

The Australian currency dipped sharply following reports of the North Korean attack on South Korea and the currency was also undermined by a general decline in risk appetite as equity markets came under pressure.

Domestically, there was a decline in construction work for the third quarter and there will be underlying fears over a significant slowdown which will tend to curb currency support. The Australian dollar retreated to lows near 0.9710 before a recovery to the 0.98 area.