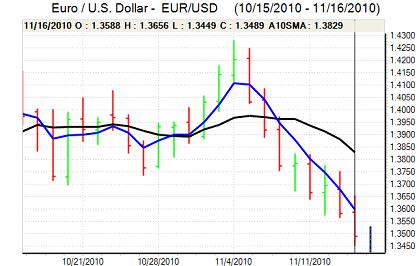

EUR/USD

Confidence in the Euro-zone remains weaker with further severe stresses surrounding the Irish bond market while there were increased fears surrounding Portugal. There were comments from the Portuguese government that it could be forced to withdraw from the Euro if the 2011 budget was not passed while the EU president warned that the Euro was in serious danger.

Although these comments are in part brinkmanship designed to force political agreement, they are unlikely to boost confidence in the Euro. The Austrian government also warned that it could block further aid for Greece under the existing support programme. The Ecofin meeting will be watched closely on Wednesday with further pressure on Ireland to accept a support package and ease market uncertainty.

The German ZEW index was stronger than expected with a gain to 1.8 for November from -7.2 the previous month. The data will help boost confidence in the German economy, but there will continue to be fears over economic divergence as the weaker economies remain under recession conditions.

The latest capital account data recorded net long-term inflows of US$81bn for September from US$128.7bn the previous month. Solid long-term inflows should help underpin underlying confidence in the dollar to some extent with investors still showing interest in US securities.

The US economic data did not have a major impact with attention generally focussed elsewhere, although US Treasury yields did decline. The industrial output data was weaker than expected with no change for October while there was a small increase in the NAHB housing-market index.

Despite lower US yields, the Euro weakened to seven-week lows near 1.3450 before finding support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar has been able to maintain a solid tone against the yen with a further attack on resistance above the 83.20 level against the yen and a peak just above 83.50. The dollar was hampered to some extent by a decline in US Treasury yields following a surge higher over the past week, although the technical outlook remained more constructive.

The yen was also broadly resilient on the crosses as risk appetite was generally weaker. There will be fears that Euro-zone tensions will trigger capital repatriation of European bond holdings and the mood of caution is being enhanced by speculation that China will need to increase interest rates further to cool inflationary pressure.

Sterling

The headline UK inflation rate was slightly higher than expected for October with a rise to 3.2% from 3.1% while the core rate was steady at 2.7% and Sterling pushed higher in an immediate reaction with a peak just below 1.61 against the dollar.

The UK currency was unable to sustain the gains and dipped sharply from just ahead of the US open. Bank of England Governor was forced to write a letter to the Chancellor to explain why the rate was more than 1.0% above the 2.0% target rate. In the letter, King stated that the inflation outlook was highly uncertain. He also commented that the bank could do more quantitative easing if required.

The comments overall dampened market expectations that the Bank would resist further quantitative easing and this had a negative impact on Sterling sentiment.

The UK currency was also unsettled to some extent by a deterioration in global risk appetite while there was some possibility that wider European fears had a negative impact. Sterling dipped to lows below 1.5850 against the dollar before some corrective recovery while the Euro consolidated near 0.85.

Swiss franc

The dollar maintained a firm tone against the franc on Tuesday with an advance to an 8-week high near parity while the Swiss currency, surprisingly, also underperformed against the Euro.

There was a 0.4% decline in Swiss producer prices for October compared with expectations of a small monthly increase and the data will tend to increase deflation fears to some extent which would increase pressure for the National Bank to stem franc gains.

The franc should still gain underlying support from the Euro-zone stresses with potential defensive inflows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

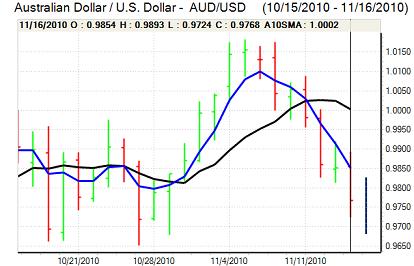

Australian dollar

The Australian dollar did find some initial support close to 0.9820 against the US currency on Tuesday, but struggled to secure much of a recovery and was subjected to renewed selling pressure later in the day with lows near 0.9725 against the US currency.

There was a general deterioration in risk appetite which curbed Australian dollar support, especially with fears that China would tighten monetary policy further. The currency was also undermined to some extent by greater doubts over the domestic economy.