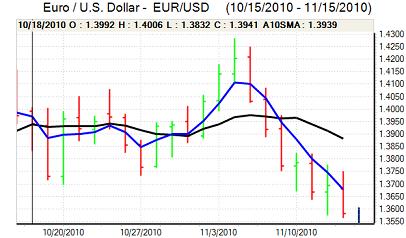

EUR/USD

The Euro initially found support close to 1.36 against the dollar on Monday and attempted to rally early in the US session, but gains quickly attracted selling pressure and there was a retreat to six-week lows below 1.3580 later in the day.

There were further important stresses within Euro-zone bond markets with a strong focus on Ireland amid increased speculation that the country will seek a EU support package. Euro-zone Finance Ministers will meet on Tuesday with a wider EU gathering on Wednesday and there will be pressure on Ireland to negotiate a package quickly during these meetings to ease market tensions.

There will, however, also be fears over a wider contagion effect with major investor fears over Portugal and to a lesser extent Spain even if any Irish agreement triggers short-term relief. A wider loss of confidence in European markets could put the Euro under strong selling pressure.

The US retail sales data was stronger than expected with a 1.2% increase for October while there was a solid 0.4% increase in underlying sales. In contrast, there was a much weaker than expected New York Empire PMI index which fell to -11.1 from 15.7 the previous month. The series is erratic, but the very sharp decline will cause important unease.

Despite the PMI report, a reduction in long US Treasury positions pushed yields higher and this also had a positive impact on the dollar. The Euro recovered back above 1.36 on Tuesday with generally dovish comments from FOMC member Dudley.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high near 83.15 in early US trading on Monday and, despite a sharp decline following the US data releases was able to post a 5-week high near 83.25 later in the US session before drifting weaker.

Yield considerations remained important with the dollar gaining additional support from a rise in US Treasury yields with markets attempting to take a more optimistic tone on the US economic prospects. A weaker than expected report on Japan’s services sector will also have some negative yen impact.

There will continue to be reservations over aggressive capital outflows from Japan and this will tend to provide some degree of protection for the Japanese currency with the dollar hitting further tough resistance above 83.20.

Sterling

Sterling found support on dips to the 1.6030 area against the dollar on Monday and was generally resilient while it maintained a firm tone against the Euro with a peak near 0.8450.

In the short term, Sterling will continue to gain protection from a lack of confidence within the Euro-zone with the potential for some defensive capital inflows. There are, however, important risks to Sterling from the Euro-area weaknesses and sentiment is liable to swing sharply. There will be concerns that UK growth will be undermined and there will also be fears that the domestic banking sector could be damaged.

The UK economic data will also be watched closely with the consumer inflation data on Tuesday followed by employment data and the MPC minutes on Wednesday. The immediate impact may prove to be broadly neutral and MPC member Weale stated on Monday that there were no compelling reasons for an easing or tightening of policy at this stage.

Swiss franc

The dollar edged higher against the franc during Monday, but encountered tough resistance above 0.9860 before drifting slightly weaker. The dollar was hampered by a solid franc performance on the crosses as Euro rallies stalled quickly while the US currency also failed to hold its best levels against all the European currencies.

The Euro-zone vulnerabilities will remain an important short-term focus and there will be further defensive support for the currency as fears over a contagion effect within the Euro area increase. There may, however, be some doubts over the Swiss banking sector which may limit support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

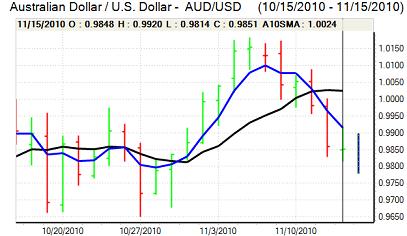

Australian dollar

The Australian dollar pushed to a high near 0.9920 against the US dollar on Monday, but was unable to sustain the gains and weakened again in Asian trading on Tuesday.

Domestically, the latest Reserve Bank minutes stated that the decision raise interest rates in November had been finely balanced and that consumer spending was weaker. These comments severely undermined any expectations of a further near-term increase in interest rates which curbed Australian dollar support.

There was also a cautious tone in commodity markets with pushed the currency weaker, but it held above the 0.9820 support zone against the US dollar.