Why should we be surprised?

Why should we be surprised?

The last G20 meeting ended in chaos, the same nonsense that triggered a flight into commodities in Q3 as Global investors lost faith in ALL of the World leaders to be able to solve ANY of the many problems that face the Global Economy. Why should this time be different as the current conference broke up with NOTHING accomplished other than to promise to get right on these issues at next year’s meeting. REALLY? Do we look like a planet that has another 6 months to wait for you to do something???

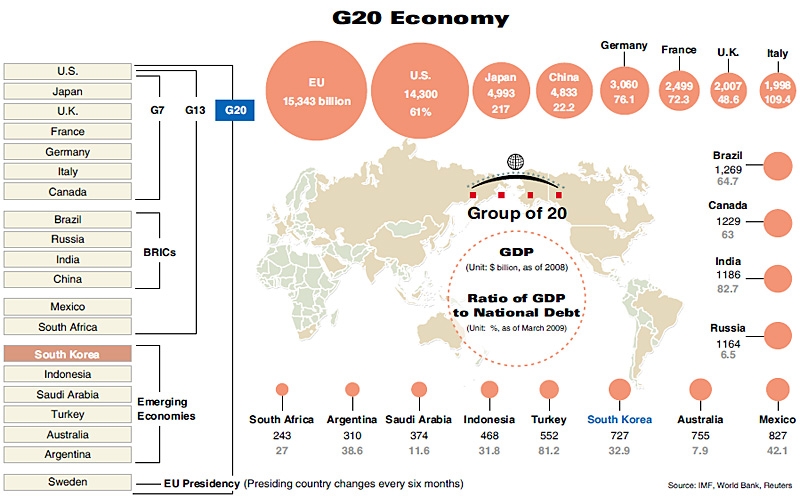

The delay by the Group of 20 industrial and developing powers in defining the external imbalances they had vowed to address represents a blurring of what at first had appeared to be clear goals designed to counter the growing threat of trade and currency wars, in which countries seek competitive advantage by weakening their currencies. The U.S. and G-20 host South Korea ran into strong opposition from such exporting powers as China and Germany to a proposal to quantify limits on current-account surpluses and deficits. Without cooperation, the IMF warns, not only will the G-20 fail to achieve a much-needed boost to growth, but it could tip the scales on the European sovereign-debt crisis and fuel capital flows into emerging countries that overheats their economies.

China is already overheating, with a 4.4% inflation rate but that’s much worse when you consider that Food Inflation was 10.1% in October from the previous year. With average family incomes of less than $2,000 – food is pretty much all these poor people can afford! The other thing people MUST buy in China (because they can do without furniture, manufactured clothing and power) is housing, and that rose 4.9% in the past year despite the BOC’s aggressive tightening measures. A lot of this is due to the Yuan’s peg to the dollar as Bernanke’s mad plan to devalue the Dollar is dropping China’s currency as well and that’s good for the manufacturers, who benefit from competitive export prices, but bad for their workers, who need to eat.

China is already overheating, with a 4.4% inflation rate but that’s much worse when you consider that Food Inflation was 10.1% in October from the previous year. With average family incomes of less than $2,000 – food is pretty much all these poor people can afford! The other thing people MUST buy in China (because they can do without furniture, manufactured clothing and power) is housing, and that rose 4.9% in the past year despite the BOC’s aggressive tightening measures. A lot of this is due to the Yuan’s peg to the dollar as Bernanke’s mad plan to devalue the Dollar is dropping China’s currency as well and that’s good for the manufacturers, who benefit from competitive export prices, but bad for their workers, who need to eat.

“Dollar issuance by the United States is out of control, leading to an inflation assault on China,” the Chinese commerce minister said in comments reported on Tuesday. Chen Deming, speaking at a trade fair in southern China, said that exporters…